Berkshire Hathaway's (BRKB) annual shareholder meeting isn't the only investor event going on in Omaha this weekend.

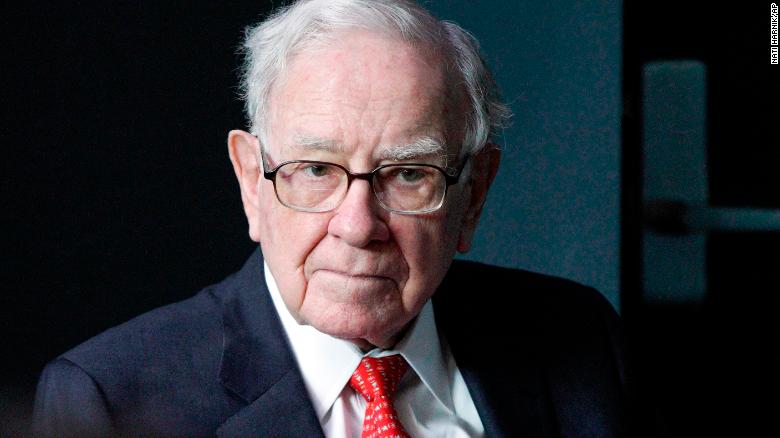

A group of top female investors held what they dubbed the Variant Perspectives Conference on Friday at the Hilton across the street from the CHI Health Center where the Berkshire gathering was taking place...and Buffett showed up.

Buffett said it was "long overdue" for a conference led by women investors, adding that "track records should open doors." He also said:

The stock doesn't know who owns you."

Barbara Ann Bernard, founder and chief investment officer of Wincrest Capital and one of the Variant event's organizers, told me she was thrilled that Buffett showed up and noted that after years of not having many high profile women at Berkshire, the company now has four female directors on its board.

"Men are not the problem. They are the solution," Bernard said.

Bernard noted that hedge funds run by women have outperformed a broader index of funds over the past few years. That's proof that more women deserve a chance to be portfolio managers.

"This isn't a pity party," she said. "The issue is scale. We need more mentors."