Editor’s note: The annual TFSA dollar limit has been $6,000 since 2019.

It’s the time of year when Canadians are bombarded with ads about filling up their Registered Retirement Savings Plans, or RRSPs. Maximizing your contribution before the March 1 deadline is simply the wise and financially responsible thing to do, the message goes.

But is that right?

No one would quibble about the importance of saving for retirement. But whether you should put your hard-earned savings into an RRSP isn’t always obvious. In some cases, you’d be better off with a Tax-Free Savings Account (TFSA), according to Ted Rechtshaffen, head of Toronto-based TriDelta Financial.

SIGN UP FOR ERICA ALINI’S UPCOMING WEEKLY MONEY NEWSLETTER:

RRSP vs. TFSA basics

Both are personal savings accounts that help you boost your savings by sheltering them from tax. You can open RRSP and TFSA accounts at a financial institution and then invest your money in them, either with the help of a professional or on your own. With few exceptions, any return your money earns while inside either an RRSP or a TFSA is exempt from tax.

READ MORE: How much do you really need for retirement? We did the math

Some of the differences:

- Gas prices surge in some parts of Canada. What’s causing pain at the pumps?

- ‘She gets to be 10’: Ontario child’s heart donated to girl the same age

- Buzz kill? Gen Z less interested in coffee than older Canadians, survey shows

- Indigo nears privatization but experts warn turnaround won’t be ‘quick fix’

- RRSPs have been around since 1957. TFSAs weren’t a thing until 2008, when the Conservative government of former prime minister Stephen Harper introduced them. Because TFSAs are newer, Canadians tend to be more familiar with RRSPs.

- While RRSPs are specifically meant to help you save for retirement, TFSAs work well for a variety of savings goals.

- You need to have earned income to put money into an RRSP. That requirement doesn’t exist for TFSAs.

- RRSP contributions are capped at 18 per cent of the earned income you reported on your tax return the previous year, up to a maximum amount ($26,010 for 2017). TFSA deposits currently have an annual limit of $5,500. In both cases, you can carry forward your unused contribution room, up to a limit of $57,500 for TFSAs in 2018. However, if you choose to take money out of an RRSP, you lose your contribution room and don’t get to catch up later, although there are some exceptions. With a TFSA, withdrawals free up room for new deposits, which you’re allowed to make beginning the following year.

- There is no minimum age for opening an RRSP, but in the year you turn 71, you must stop making contributions and convert the account into either an annuity or a so-called Registered Retirement Income Fund (RRIF), which requires that you make minimum withdrawals every year. With a TFSA, you need to be 18 to open an account, but there’s no upper age limit for making deposits – and you don’t have to take money out if you don’t want to.

READ MORE: Why maximizing your RRSP contribution simply isn’t enough

But arguably the most important difference between the two is about how taxes work when the money goes in and when it comes out:

- Money going in. With an RRSP, the government doesn’t tax you on the money you put it. That’s why you generally get a tax refund when you make a lump-sum deposit into an RRSP. You essentially overpaid your income taxes, and now the taxman is returning the taxes you paid on the money you used for the contribution. With a TFSA, you make deposits with after-tax dollars – so no tax refund.

- Money coming out. RRSPs aren’t exactly a free lunch. Because you skipped taxes while putting money in, the taxman will get you when you take money out. The taxes on your withdrawals from an RRSP or RRIF are based on your income level the year you take money out. With a TFSA you can withdraw whenever you want with no tax consequences because you already paid your due.

RRSP taxation is based on the idea that you won’t need as much money in retirement as you did during your working life. If the kids have moved out and your mortgage is paid off, for example, it’s easy to see why that would be the case. If your income in retirement is lower, the taxes you don’t pay on money going into an RRSP are higher than the taxes you’ll have to pony up when you take money out in old age, and you come out ahead.

READ MORE: Money123 – the easy way to be smart with your money

On the other hand, if your expenses — and the level of income you need to cover them — aren’t going to change much after retirement, you might be better off with a TFSA. That’s all the more so if your income rises in retirement, which happens more often than people think, according to Rechtshaffen.

WATCH: When it comes to saving for retirement, starting early pays off

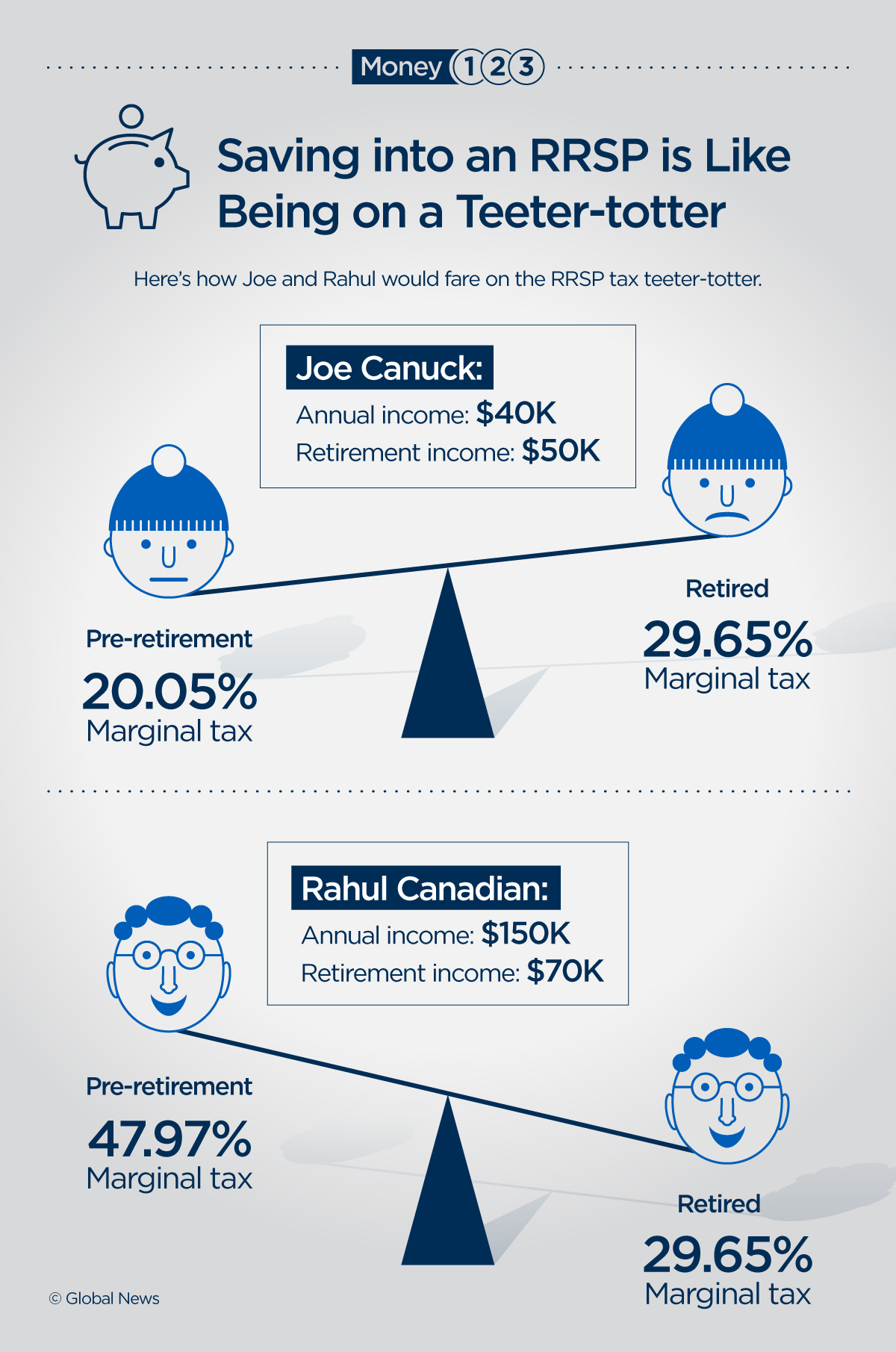

RRSPs are like teeter-totters, TFSAs are like benches

Saving for retirement in an RRSP is like being on a teeter-totter. It works best when you start high and end low. “You want to ideally receive a tax refund at a rate that is higher than the rate of tax you will pay when you take the money out,” Rechtshaffen said.

Using a TFSA, on the other hand, is like sitting on a bench from a tax point of view. Every dollar you put in is taxed based on your income that year, and that’s the end of the story.

READ MORE: Plan to use your RRSP for a down payment on a house? Don’t do it.

Let’s take a look at how that works in practice. Imagine someone — let’s call him Joe Canuck — starts working at 25 making $40,000 a year. Based on his income, Joe would get a 20.05 per cent tax refund on RRSP contributions in Ontario. Let’s assume that his earnings remain fairly steady but grow slightly more than inflation throughout his working life and that he’ll need roughly the same amount of money pre- and post-retirement to cover his expenses. If at retirement his income is an inflation-adjusted $50,000, this would be taxed at 29.65 per cent, assuming no tax changes. The RRSP tax teeter-totter isn’t working in Joe’s favour. At age 90, he would have been over $400,000 better off investing in a TFSA, assuming identical returns on investment in the two accounts, calculates Rechtshaffen.

READ MORE: Looking for last-minute RRSP advice? Warren Buffett thinks you should buy index funds

Even if Joe remained in the 20.05 per cent tax bracket in retirement, an RRSP wouldn’t offer him a tax advantage. His teeter-totter would be flat, with money coming out taxed at the same rate as the money he put in. Worse, Joe’s RRIF withdrawals would likely push him above the income threshold for the Guaranteed Income Supplement (GIS) that is available to many low-income retirees. If Joe took his retirement income from a TFSA, on the other hand, the government wouldn’t count that as income, meaning the money would have no impact on his benefit eligibility.

Now let’s look at Rahul Canadian, who makes $150,000 and is thinking he’ll need $70,000 a year in retirement. Rahul would get an RRSP contribution refund at a rate of 47.97 per cent, while his income in retirement would face a marginal tax rate of 29.65 per cent. Needless to say, RRSPs are a much better fit for Rahul than for Joe from a tax point of view.

TFSAs might be a better option for young people, too

For many people, earnings tend to go up significantly as they progress through their career. So what are the implications there?

Let’s say Rahul starts out his first job making $40,000. At first, all his retirement savings should go to his TFSA, according to Rechtshaffen.

At a certain point, Rahul’s income will have grown much more than $40,000 and all his savings should go to his RRSP. “For example, if he earns $60,000, and saves $6,000, then even after the RRSP deduction, his taxable income would be $54,000, and he would be in the 30 per cent marginal tax bracket in Ontario,” Rechtshaffen said.

READ MORE: Boomers, gen-X, millennials: How living costs compare then and now

If you’re not getting a tax advantage out of money you put into an RRSP, you might as well use a TFSA, where withdrawals come with far fewer strings attached.

“The only caveat is that the tax refund money can grow larger if it is invested for retirement the younger you are, whereas if you are 60, that money will grow for less time before you might need to spend it,” Rechtshaffen said.

WATCH: Finance Minister Bill Morneau announces tax cuts, lower TFSA contribution limit

Higher income in retirement can tilt the teeter-totter

The tax treatment of RRSPs can also become tricky when your income in old age winds up being higher than it was pre-retirement. Rental income or an inheritance, for example, can put you in a higher income bracket post-retirement. So can the death of your spouse, when most of the income you used to split now shows up on your tax return alone. In addition to ending up at the wrong end of the teeter-totter, that could also result in a clawback of your Old Age Security (OAS) pension, which starts at around $75,000 of annual income.

With a TFSA, on the other hand, withdrawals don’t count as income, meaning money taken out has no implication on the tax you’ll have to pay on other income.

With a TFSA, Rechtshaffen said, “you just have a little bit more control.”

TO CELEBRATE THE LAUNCH OF THE MONEY123 NEWSLETTER WE’RE GIVING OUT $500:

Disclaimer – Global News provides the information contained in this series for informational purposes only. It is not to be used or construed or relied upon as financial, legal, tax, accounting or other professional advice or recommendations regarding the suitability, profitability or potential value of any particular investment, product, service or course of action. The information provided does not replace consultations with professional advisors and it is recommended that you seek appropriate independent advice from qualified professional advisors before making any financial or other decisions. Global News shall not be responsible or liable in any way for any loss or damage directly or indirectly incurred as a result of, or in connection with, the use of such information by you.

Comments