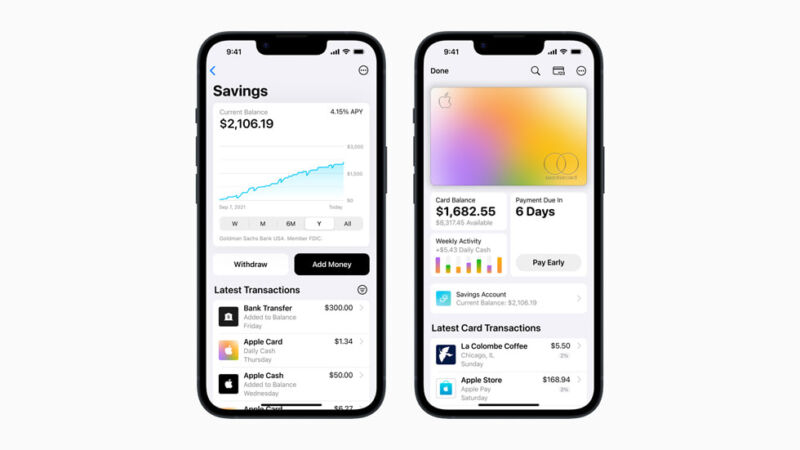

Apple today launched its first savings account, letting Apple Card credit card owners open a high-yield savings account through the company. The service, available through partner Goldman Sachs, offers a 4.15 percent annual percentage yield (APY) and has no minimum balance or deposit requirements or fees.

Apple previewed the savings account a little over six months ago in October. Per today's announcement, Apple Card users who choose to open a savings account will see cash back earned from Apple Card purchases (up to 3 percent, depending on the merchant) automatically go into their savings account. If they don't like this, they can change where the cash back goes through the Apple Wallet app.

Savings account holders can manage things via a Savings dashboard in the Wallet. The dashboard will let users link another (non-Apple) banking account for feeless transfers in both directions, as well as conduct transfers to and from an Apple Cash Card.

The new service comes as Apple has increasingly expanded its reach beyond the generally declining smartphone market. Late last month, it finally (after some delays) launched Apple Pay Later, which essentially turned the tech giant into a money-lender with the help of Goldman Sachs and MasterCard, to select customers. Everyone else is supposed to have access to the service "in the coming months," Apple said in March. Besides financial services like the Apple Card MasterCard (backed by Goldman Sachs) and the new savings account, Apple has its hands in areas like video streaming, the cloud, and fitness services to make itself less dependent on unreliable and declining device sales.

The Apple and Goldman Sachs savings account looks like an attempt to further diversify Apple's business and get customers more deeply entwined with the company. On its own, the savings account doesn't do much to woo people who don't have Apple Cards (you can find high-yield savings accounts with similar APYs and fee deficits). It makes more sense for people who own or would consider owning an Apple Card, as it simplifies building savings through cash back, as well as Apple hardware users who can leverage the convenience of account management through Wallet.

reader comments

137