Where to Invest $100,000 In Asia Right Now

Five experts spotlight opportunities for investors in the region

Finding robust returns on investments — or even safe havens — is hard going in Asia at the moment.

It’s been a bumpy six months, with accelerating inflation, interest rate hikes, local currencies slumping against the US dollar and volatile markets. And it all comes against the backdrop of ongoing economic turmoil in China.

To find pockets of opportunity in these turbulent times, we asked five experts where they’d invest $100,000 in Asia now. Ideas stretch from Taiwanese tech companies and Chinese convertible bonds to cryptocurrency and telecommunications firms.

When asked where they might personally invest $100,000 in something they’re passionate about, the experts’ answers were equally varied, ranging from large gemstones and vintage gasoline-powered cars to champagne, rare collectibles and even British pubs.

To find ways to play the themes laid out below using exchange-traded funds, Hong Kong-based Bloomberg Intelligence ETF analyst Rebecca Sin weighs in.

Before jumping into the markets, it’s smart to make sure you have enough money in liquid investments so that you won’t need to sell into a down market if a sudden expense hits. It’s also important to stay well-diversified across asset classes, investment styles and geographies.

2022 Q3

In Asia, I would only invest in equities. The countries I would concentrate on are Taiwan, India and Vietnam. There are excellent opportunities in those countries, although I would not exclude other countries if I could find the kind of companies that would meet my criteria.

I have three basic parameters when I look at companies: earnings growth — there has to be a five-year growth average in earnings per share of at least 10%; debt — there must be low or no debt, with a debt-to-equity of less than 50%; and returns — there must be a return on equity, return on assets and return of invested capital of at least 20%.In Taiwan, I would focus on technology companies such as ZillTek Technology, Elite Material, Sinbon Electronics, Parade Technologies, Win Semiconductors and E Ink Holdings. Taiwan is a leader in the semiconductor field and companies such as these have a great future ahead of them.

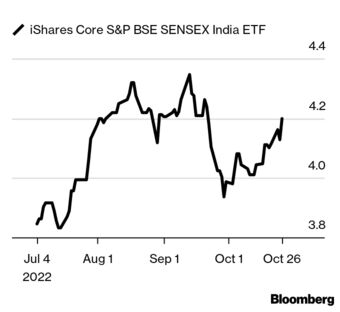

In India, I would focus on software companies such as Persistent Systems and in infrastructure companies such as APL Apollo Tubes.

In Vietnam, my focus would be on consumer companies such as Vietnam Dairy Products JSC.

The important feature of investing in Asia is paying close attention to corporate governance and focusing on companies that are trying their best to improve or maintain good corporate governance. Of course, consistent with the objective is a focus on the E and S factors and not only the G in the ESG picture.

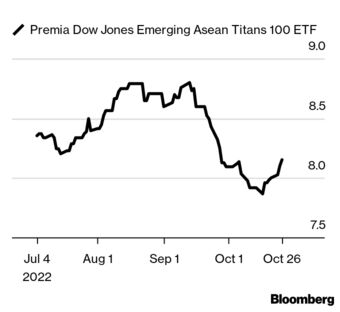

covers high-growth companies across Indonesia, Thailand, Malaysia, Philippines and Vietnam, with a management fee of 0.5%. The Global X Asia Pacific High Dividend Yield ETF (3116 HK)

covers high-growth companies across Indonesia, Thailand, Malaysia, Philippines and Vietnam, with a management fee of 0.5%. The Global X Asia Pacific High Dividend Yield ETF (3116 HK) tracks top sectors including semiconductors, transportation and mining across Australia, Taiwan, South Korea, Japan and Hong Kong, charging 0.68%. The iShares Core S&P BSE Sensex India ETF (9836 HK)

tracks top sectors including semiconductors, transportation and mining across Australia, Taiwan, South Korea, Japan and Hong Kong, charging 0.68%. The iShares Core S&P BSE Sensex India ETF (9836 HK) covers equities in India with top sectors including banks, computer, oil and gas and agriculture, and a fee of 0.64%.

covers equities in India with top sectors including banks, computer, oil and gas and agriculture, and a fee of 0.64%.

One promising area to watch in the coming quarters are markets that were crushed in 2022 by the exceedingly strong US dollar. We favor emerging markets that aren’t tied to commodity producers and North Asian countries such as Hong Kong/China, Taiwan and Korea because of their favorable risk/reward.

The extreme pace of US monetary policy tightening this year has resulted in a surge in the US dollar against its trading partners. We think we are in the seventh inning of this divergence in growth and in policy. Global central banks such as the Bank of Japan, the People’s Bank of China and many others have started to actively defend their currencies. If other central banks start to let rates drift upward, or once the tightening impacts on the US economy start to show through lower inflation or much weaker data, we think the dollar will peak in the coming months.

Another potential driver for convergence between the value of the US dollar and other currencies would be any policy directional changes in China, where strict adherence to Covid Zero policies have hindered the growth-boosting effects of other stimulative fiscal or property policies. Any fine-tuning or easing of strict Covid restrictions could meaningfully boost growth sequentially off a very low base.

In such scenarios that lead to an inflection in the US dollar strength, markets most strained by recent local currency depreciation could see significant normalization of valuations. We would avoid commodities economies such as Indonesia, however, given our bearish view on the commodities price outlook as supply constraints may ease while demand is less certain.

We think Taiwan and Korea also start to look more interesting in the first half of 2023 once the tech earnings cuts have come through. We believe major tech leaders in memory chips and semiconductors may lead the rebound in 2023. China’s potential sequential economic improvement could give markets a short-term boost into the coming quarters, although longer-term potential hinges more on structural policy direction and geopolitics. Sectors in China that we think may outperform on any bounce include internet, consumer discretionary and insurance/brokers.

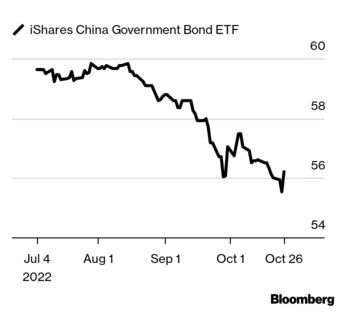

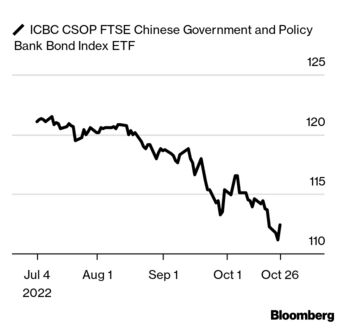

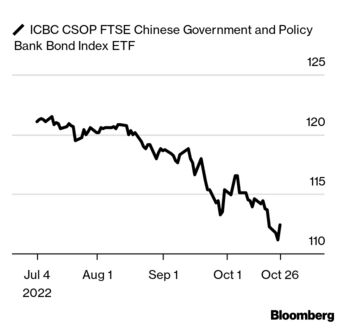

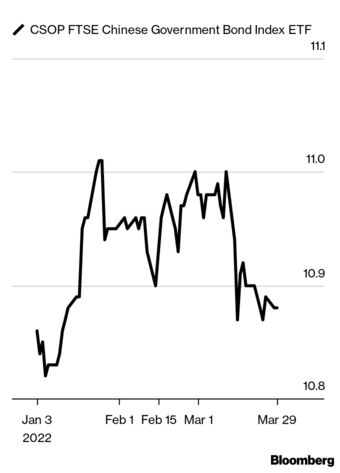

offers yuan-denominated fixed-rate government bonds with average yield to maturity of 2.56% and effective duration of 5.65 years, charging a management fee of 0.18%, Sin said. Another option would be the ICBC CSOP FTSE Chinese Government and Policy Bank Bond Index (3199 HK)

offers yuan-denominated fixed-rate government bonds with average yield to maturity of 2.56% and effective duration of 5.65 years, charging a management fee of 0.18%, Sin said. Another option would be the ICBC CSOP FTSE Chinese Government and Policy Bank Bond Index (3199 HK) , which holds 53% sovereign and 47% bank bonds and has a fee of 0.28%. For the tech play, BetaShares Asia Technology Tigers ETF (ASIA AU)

, which holds 53% sovereign and 47% bank bonds and has a fee of 0.28%. For the tech play, BetaShares Asia Technology Tigers ETF (ASIA AU) offers exposure to technology and internet companies across China (52%), Taiwan (19%) and South Korea (18%), and charges 0.67%.

offers exposure to technology and internet companies across China (52%), Taiwan (19%) and South Korea (18%), and charges 0.67%.

The current investment theme is finding assets that outperform the market when economic growth slows yet can also do well if market strength returns.

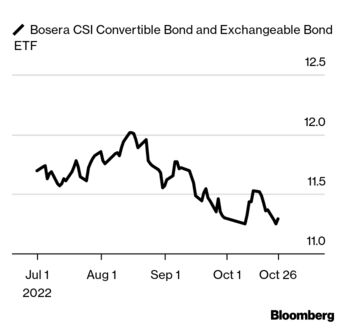

One example is China convertible bond funds. Chinese convertible bonds are trading at historically low levels and they have a unique ability to offer downside protection in a falling market. They have a stable yield of 4% to 5% and a strong ability to outperform when China A-shares rebound, which we expect in the fourth quarter after the Communist Party congress.

Another theme is serviced apartment remodeling funds in China focusing on first-tier cities, such as Beijing and Shanghai. Distressed real estate developers in China are selling core assets, such as hotels, in these cities. Some distressed managers are buying them at a 30% discount and changing them into apartments that offer fully furnished accommodation for short- or long-term stays and services such as housekeeping.

These apartments meet an increasing demand from young professionals, who prefer renting high-quality serviced apartments to buying property in a down cycle. This remodeling and operating model captures the distressed opportunities in China’s real estate market, with the potential for a stable inflation-sensitive rental income. And there is also a potential upside should the property market rebound in the long run.

invests at least 80% of assets into bonds, with top industry groups being banks, transportation and utilities, Sin said. This fund has returned 5.83% per annum since inception. For Chinese property plays, the Premia China USD Property Bond ETF (9001 HK)

invests at least 80% of assets into bonds, with top industry groups being banks, transportation and utilities, Sin said. This fund has returned 5.83% per annum since inception. For Chinese property plays, the Premia China USD Property Bond ETF (9001 HK) offers exposure to Chinese property US dollar bonds issued with a maximum 5% per issuer with secured and senior debts only.

offers exposure to Chinese property US dollar bonds issued with a maximum 5% per issuer with secured and senior debts only.

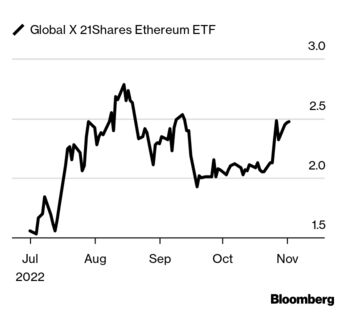

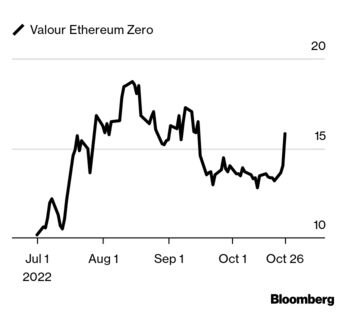

The asset I want to focus on is Ether, due to the recent dramatic shift in its investment landscape that could position it as an alternative investment to interest-bearing securities.

Ether is the native token of the Ethereum blockchain, which was revamped in September to give it better security and slash its energy use. The makeover, known as the Merge, involved moving away from a proof-of-work model that uses huge amount of energy and was similar to the one used by Bitcoin, to more eco-friendly proof-of-stake system that involves putting up, or staking, Ether as part of the process of ordering transactions and minting tokens.

In addition to the environmental benefits of moving to proof-of-stake, the update has also improved the supply dynamics of the token. Once global interest-rate markets identify the terminal rate, or end point, for rate hikes, Ether will probably move to being a deflationary asset. This could see quite a rapid reduction in total Ether supply.

The price of Ether has certainly suffered from quantitative tightening and central bank action, falling nearly 70% from its November 2021 highs. My base thesis is that cryptocurrencies are a central bank hedge, rather than a direct inflation hedge.

Ether is best purchased in lots of 32. That’s the minimum amount you’re required to stake to become a “validator.” While a validator node is quite technical to run yourself, you can use staking pools that allow any Ether holder to benefit from assigning their Ether to the process of block validation and receive a staking return. Currently, third parties are offering an annual percentage yield of about 5.2% for staked Ether (floating rate). That’s broadly equivalent to the current yield on three-year senior unsecured major bank credit.

Ether is trading at about $1,560, with strong market support at $1,000. Outside risks include regulation and smart contract hacking.

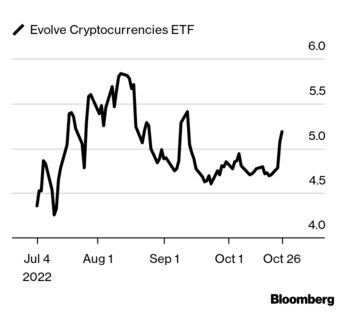

may be the easiest option as it trades during Asian hours in Australia, according to Sin. It charges a fee of 1.25%. Two free exchange-traded products with zero management fees are Valour Ethereum Zero (ETH0 FP)

may be the easiest option as it trades during Asian hours in Australia, according to Sin. It charges a fee of 1.25%. Two free exchange-traded products with zero management fees are Valour Ethereum Zero (ETH0 FP) , which trades in France, and Evolve Cryptocurrencies ETF (ETC CN)

, which trades in France, and Evolve Cryptocurrencies ETF (ETC CN) , which is based in Canada and tracks both Bitcoin and Ether.

, which is based in Canada and tracks both Bitcoin and Ether.

High-dividend companies with steady businesses are the new fixed income. We see value in building a quality, high-cash-flow portfolio to generate decent compounding returns over the next few years.

Sectors that fit into this category are telecommunications and energy companies (oil, coal, natural gas). We regard any dividend above 8% as high — for telecommunications we would be looking for 9%, for Chinese financials we’d want more than 9%, and for oil refineries more than 13%.

Hong Kong/China are the markets where we think we can find value stocks with high dividend payouts. Auditing standards remain strong within these jurisdictions and we can obtain good market information.

In terms of metrics, we assess both the balance sheet, profit and loss and cash flow statements of companies, and also board-level commitment on increasing dividend payouts and share-buyback programs.

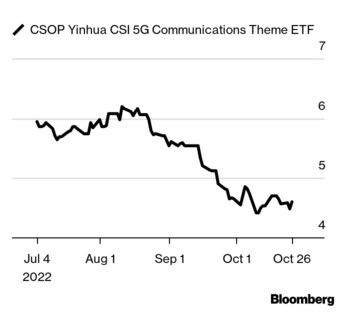

At the same time, we assess the business pros and cons. For example, with telecommunications, the peak of investing and expensing into 5G is now behind us, hence there are more revenue flows to the bottom line. In terms of Chinese banks, valuations have been trading at trough levels due to the overall property market and economic downturn, but by assessing the financial statements we are able to identify which ones are less impacted by the property-related businesses, and which ones are more positively sensitive to deposit-rate cuts from central banks.

Telecommunications is one of the most stable businesses in China (despite some being sanctioned by the US). Most Chinese citizens cannot live without data and connectivity. It’s also Covid-19-resistant, as people will continue to stream videos and message each other with or without lockdowns.

For oil, we believe both domestic demand and refinery demand will remain high in and outside of China. With the escalation of military and political tensions in Europe and the lockdowns/easing of Covid-19 restrictions, the demand for oil will remain well supported.

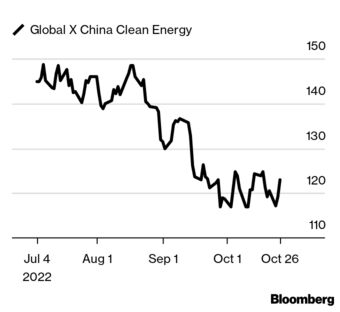

offers exposure to 5G communication companies listed on the Shenzhen Stock Exchange, charging a management fee of 2%. For broader exposure, the Global X Asia Pacific High Dividend Yield ETF (3116 HK)

offers exposure to 5G communication companies listed on the Shenzhen Stock Exchange, charging a management fee of 2%. For broader exposure, the Global X Asia Pacific High Dividend Yield ETF (3116 HK) includes top industry groups including semiconductors, transportation, mining, coal, oil and gas, with a fee of 0.68%. For more sector-focused funds, Global X China Clean Energy (2809 HK)

includes top industry groups including semiconductors, transportation, mining, coal, oil and gas, with a fee of 0.68%. For more sector-focused funds, Global X China Clean Energy (2809 HK) covers Hong Kong and Chinese energy companies and also charges 0.68%.

covers Hong Kong and Chinese energy companies and also charges 0.68%.

(Updates ETF section in the John Toro entry.)

2022 Q2

There is a lot of uncertainty in the markets given a combination of geopolitical risks, inflation and Federal Reserve rate policies, as well as persisting pandemics. A segment that is quite uncorrelated with all of this is Chinese government bonds.

China has set an ambitious economic growth target of 5.5% for the year, putting the spotlight back on fiscal stimulus to counter the risks of an ongoing property market slump and rising geopolitical tensions. Economists have said the target implies that China will increase infrastructure spending, cut interest rates further and do more to stabilize housing. These support the price of the government bonds, known as CGBs. Premier Li also reiterated a commitment to controlling overall debt levels and said the number of bonds available for local governments to fund specific projects would be the same as last year. This limits bond supply pressure a bit.

The 10-year CGBs still have a decent yield of about 2.8%. In terms of the renminbi outlook, the Russian-Ukraine conflicts are likely to boost the renminbi’s internationalization and lead to a greater desire for countries to diversify both their reserves investments and trade settlement currencies into renminbi. The Chinese renminbi spot price is expected to stay resilient in the foreseeable future, a range of 6.3 to 6.4 to the dollar in the first half of 2022, according to broker estimates. Chinese government bonds can be the new safe haven.

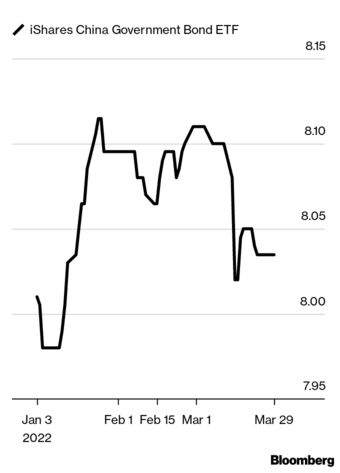

and the iShares China Government Bond (9829 HK)

and the iShares China Government Bond (9829 HK) , Bloomberg Intelligence’s Rebecca Sin said. The ETFs both have current yields of 2.7% and effective duration of 5.5 years. (Duration is a measure of a bond or bond portfolio’s sensitivity to changes in interest rates; the higher the duration, the higher the interest-rate risk.) Management fees on the ETFs are 0.25% and 0.18%, respectively.

, Bloomberg Intelligence’s Rebecca Sin said. The ETFs both have current yields of 2.7% and effective duration of 5.5 years. (Duration is a measure of a bond or bond portfolio’s sensitivity to changes in interest rates; the higher the duration, the higher the interest-rate risk.) Management fees on the ETFs are 0.25% and 0.18%, respectively.

We’re positive on Chinese equities given the decisive shift of the People’s Bank of China monetary policy stance to easing, and because last year’s regulatory clampdown appears to have paused. Looking ahead, the leaders in policy-support sectors with consistent earnings growth — such as semiconductors, new materials, green economy and biotech — would be beneficiaries of policy tailwinds and are good diversifiers for investors with concentrated exposure to Asia’s tech sector. A lot of investors currently maintaining an underweight or with a zero weight to China/Asia are closely monitoring the markets to find the appropriate window to get back in.

But even sectors that previously had light-touch regulation, such as innovative technology-enabled leaders, and that now face valuation updates and massive overhauls of business models, look more attractive. Examples include Sungrow Power Supply, Longi Green Energy Technology and Contemporary Amperex Technology, where a lot of the corrections have happened and they maintain high earnings growth and attractive price earnings-to-growth ratios.

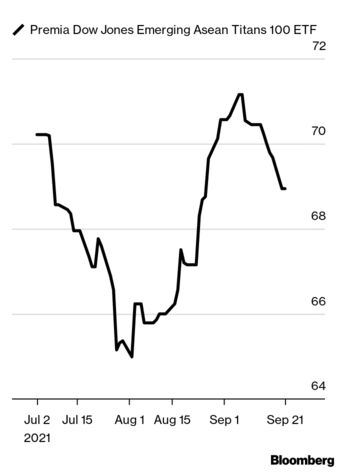

We also think prospects for many emerging markets are promising. The Asean market, especially Vietnam, is one where the long-term industrialization and urbanization growth story remains intact. We’re bullish because of its favorable macro environment, solid earnings growth outlook and reasonable valuations. Major Asean and Vietnam indexes have less exposure to growth sectors such as information technology and healthcare, and more of a tilt toward value and domestic-related sectors such as financials, consumer staples and real estate. Any big dips are a good entry point to ramp up positions for mid- to long-term investors.

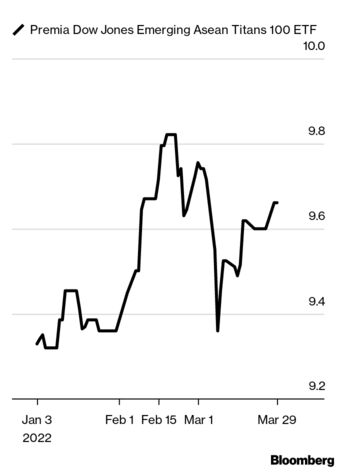

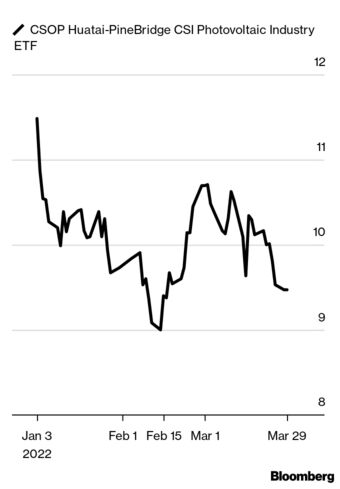

provides exposure to ASEAN countries including Thailand (25%), Indonesia (25%), Malaysia (24%), Philippines (17%) and Vietnam (7%), for a 0.50% fee, Sin said. Another potential play is CSOP Huatai-PineBridge CSI Photovoltaic Industry (3134 HK)

provides exposure to ASEAN countries including Thailand (25%), Indonesia (25%), Malaysia (24%), Philippines (17%) and Vietnam (7%), for a 0.50% fee, Sin said. Another potential play is CSOP Huatai-PineBridge CSI Photovoltaic Industry (3134 HK) which holds Longi Green Energy Technology (11%), Sungrow Power Supply (10%) and companies in China that focuses on converting sunlight into electricity — an area that has seen significant growth thanks to aggressive Chinese government stimulus plans such as carbon neutrality by 2060, Sin said.

which holds Longi Green Energy Technology (11%), Sungrow Power Supply (10%) and companies in China that focuses on converting sunlight into electricity — an area that has seen significant growth thanks to aggressive Chinese government stimulus plans such as carbon neutrality by 2060, Sin said.

Widespread fears about geopolitical risk have led a global equity market selloff. Investors are staying cautious, but we believe the downside surprise from current levels is limited given the pullback. We see industries with high domestic-business exposure performing more defensively, and a sector that is trading at attractive valuations could offer a better rebound — China’s onshore equity and internet sector.

Looking back over the past 30 years, China’s equities — and particularly China A-Share equities — have tended to be more defensive when global geopolitical risk is heightened. That’s because, first, China has an idiosyncratic nature in policymaking, and policymakers have not fully utilized available tools to support the economy, which is the opposite of what we’ve seen with the majority of developed markets. Second, Chinese companies often make most of their money domestically, with overseas revenue exposure in single digits. Third, the “risk-off” appetite is unlikely to result in a large selloff of Chinese shares, as foreign ownership is only around 4.5%. The asset class is broadly underweighted in global portfolios by approximately 450 basis points versus the benchmark, according to data provider EPFR.

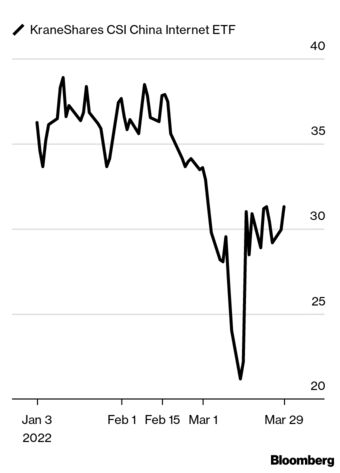

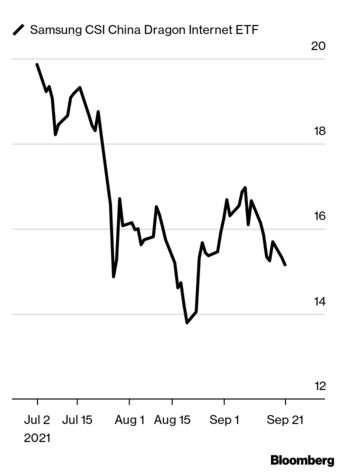

Over the past year or so, China’s internet companies aggressively revised earnings, leading to repriced valuations. On average, they are currently trading at 17.8 times earnings, compared with 34.3 times for their U.S. counterparts. The correction has created an attractive entry point for long-term investors from a fundamental perspective. Historical studies show that China’s internet sector outperformed the Nasdaq, S&P 500 and the U.S. Growth Index for seven of the last nine Federal Reserve rate-hike cycles since 2008. Even if China’s GDP is normalized in a relatively lower (around 5%) but stabilized range, the growth style tends to outperform value.

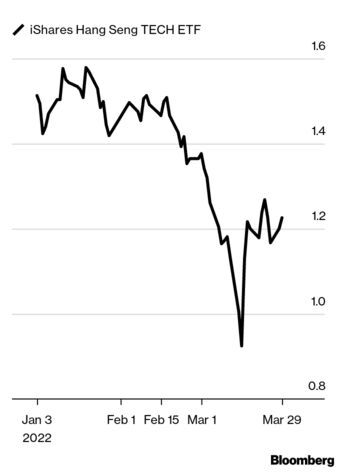

is the largest with $6.5 billion in assets and a management fee of 0.70%, Sin said. For ETFs listed in Asia, the iShares Hang Seng Tech (9067 HK)

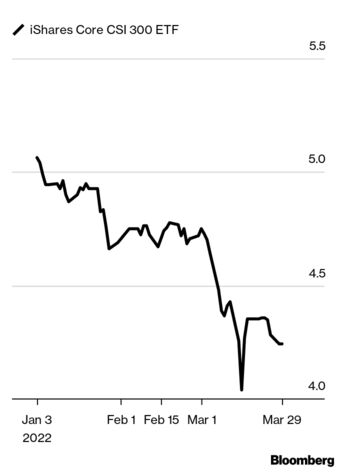

is the largest with $6.5 billion in assets and a management fee of 0.70%, Sin said. For ETFs listed in Asia, the iShares Hang Seng Tech (9067 HK) is an option, and has a 0.25% management fee. That ETF covers internet, software, telecoms and semiconductors. For China A-Shares equities, the CSI 300 Index tracks the largest market capitalization A-Shares companies, and the $60 million iShares Core CSI 300 (9846 HK)

is an option, and has a 0.25% management fee. That ETF covers internet, software, telecoms and semiconductors. For China A-Shares equities, the CSI 300 Index tracks the largest market capitalization A-Shares companies, and the $60 million iShares Core CSI 300 (9846 HK) is the cheapest with a fee of 0.38%.

is the cheapest with a fee of 0.38%.

My investment strategies are often guided by two things: opportunities due to major changes in macro conditions and policies, and the need to hedge against alarming risks.

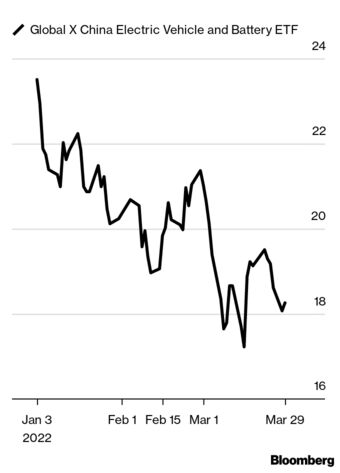

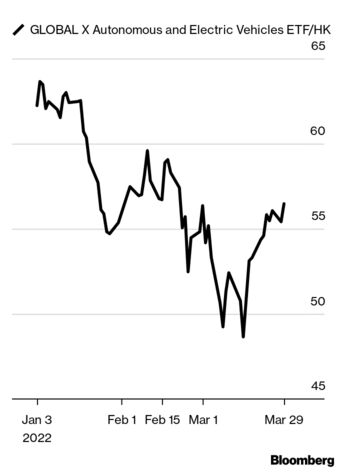

The first mega-trend is the global transition to a net-zero economy. This leads to fundamental changes and technology breakthroughs across industries. The energy transition to renewables, and transportation from combustion to electric, is leading to investment opportunities in renewable energy, electric vehicles and batteries. Chinese firms are leading in these areas, thanks to policy commitments and economies of scale. Agriculture is the biggest greenhouse gas-emitter globally, so water and space-efficient farming, and the meat to plant-based food transition, are good spots to look for opportunity.

My next idea is a hedge against bumps in the net-carbon transition, i.e. carbon credits, requiring polluters to pay to do so. The price rises as regulators tighten and company’s demand rises. Europe is leading in the carbon credit market. Shanghai opened China’s huge carbon exchange in 2021.

and the Global X Autonomous EV (2849 HK)

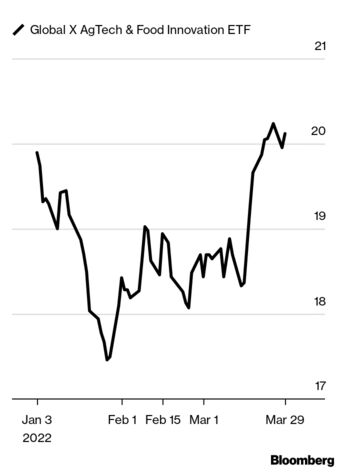

and the Global X Autonomous EV (2849 HK) , she said. To invest in the future of agriculture and food through innovation, technology and a controlled environment, the Global X AgTech and Food Innovation (KROP US)

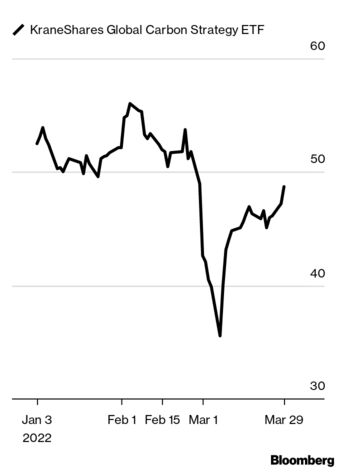

, she said. To invest in the future of agriculture and food through innovation, technology and a controlled environment, the Global X AgTech and Food Innovation (KROP US) targets the entire ecosystem; it has a 0.50% fee. For carbon-credit strategies, there’s the KraneShares Global Carbon Strategy (KRBN US)

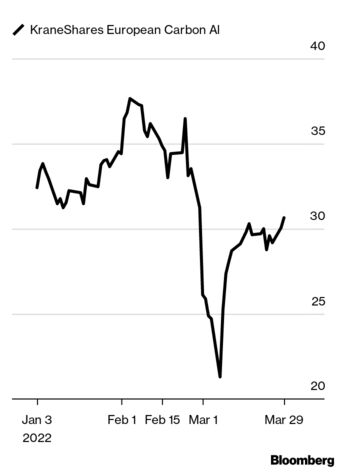

targets the entire ecosystem; it has a 0.50% fee. For carbon-credit strategies, there’s the KraneShares Global Carbon Strategy (KRBN US) , the European Carbon Allowance (KEUA US)

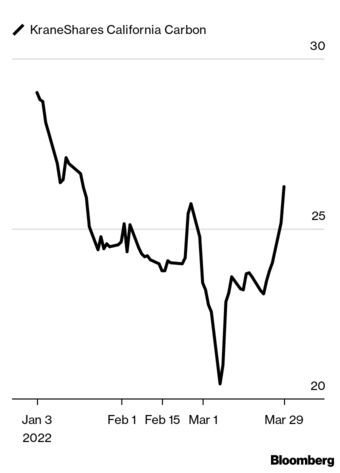

, the European Carbon Allowance (KEUA US) and the California Carbon Allowance Strategy (KCCA US)

and the California Carbon Allowance Strategy (KCCA US) , all with a 0.79% management fee.

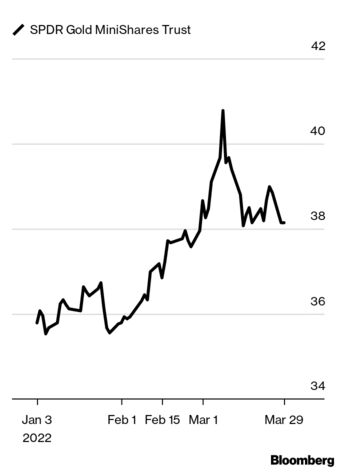

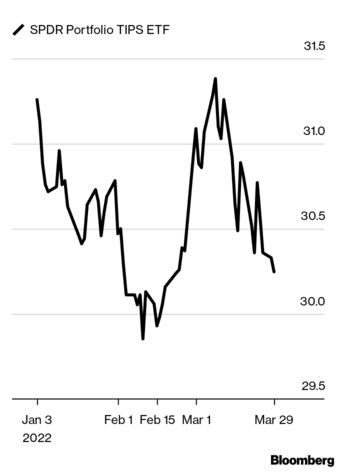

, all with a 0.79% management fee.To hedge against inflation, gold has often been a popular choice as it’s physical, holds its value and is often viewed as a safe haven asset, said Sin. For an ETF tracking gold, SPDR Gold MiniShares Trust (GLDM US)

is one of the cheapest funds, charging 0.10%. Another option are Treasury inflation-protected securities (TIPS), which are government bonds indexed to inflation. The SPDR Portfolio TIPS ETF (SPIP US)

is one of the cheapest funds, charging 0.10%. Another option are Treasury inflation-protected securities (TIPS), which are government bonds indexed to inflation. The SPDR Portfolio TIPS ETF (SPIP US) tracks the Bloomberg U.S. Government Inflation-Linked Bond Index and charges 0.12%.

tracks the Bloomberg U.S. Government Inflation-Linked Bond Index and charges 0.12%.

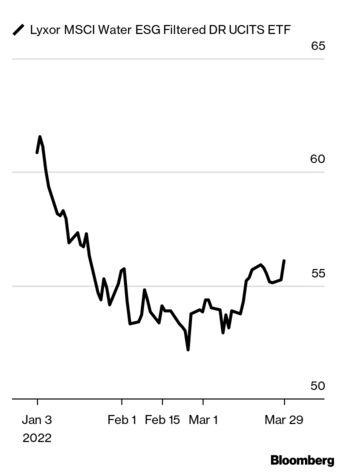

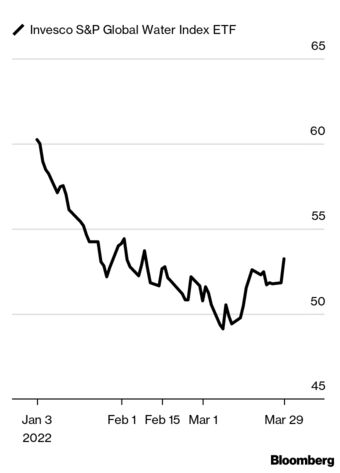

Covid has taken up lots of attention from the Chinese government. Now more than ever is a great time to look at the generative water system in China, as health and virus control is a top priority. The Chinese government is determined to improve the environment, especially natural resources like rivers and lakes, and is constantly issuing new policies, even more so now after the pandemic.

There is great demand to clean up the effects of industrial pollution and do algae cleanup in lakes and rivers. As the quality of life improves in China, people are more conscious about the source of their water, the seafood supply chain, and the importance of a good environment in which to live and play. All these environmental factors will lead more companies in this sector to grow and provide better solutions. These companies are mostly small- to mid-size, and many are publicly traded.

Governmental initiatives will be the key for growth since the rivers and lakes are owned by the government. But China is open to sourcing technology from around the world so that they can develop their best innovations. One example of a company that has been doing that is Suez Environment, a French company that is deploying its technology in more than 30 cities in Asia, and which was recently acquired by Veolia Environnement (VIE FP). Veolia optimizes resource management services and designs and provides water, waste and energy management solutions. The biggest risk investors face with these companies is cash flow. This is a long-term play, requiring a lot of innovation and deployment, but the potential is huge.

tracks the MSCI ACWI IMI Water ESG Filtered Index, has a 0.60% management fee and $1.3 billion in assets. The fund tracks distribution, utilities, equipment, and treatment of all things related to water, Sin said. For broader exposure including utilities, infrastructure, equipment, instruments and materials, she pointed to Invesco S&P Global Water (CGW US)

tracks the MSCI ACWI IMI Water ESG Filtered Index, has a 0.60% management fee and $1.3 billion in assets. The fund tracks distribution, utilities, equipment, and treatment of all things related to water, Sin said. For broader exposure including utilities, infrastructure, equipment, instruments and materials, she pointed to Invesco S&P Global Water (CGW US) as another option; the ETF has a 0.59% fee and $1 billion in assets. Its year-to-date performance is around -17% but over the past two years returns have been around -12.4%. Both ETFs hold about 5.8% of Veolia.

as another option; the ETF has a 0.59% fee and $1 billion in assets. Its year-to-date performance is around -17% but over the past two years returns have been around -12.4%. Both ETFs hold about 5.8% of Veolia.

Innovation remains a theme we favor globally and is very much in evidence in Asia. Given the current geopolitical environment and the critical need to shift to lower-carbon energy, renewable energy innovation will accelerate and get government support around the world.

Artificial intelligence will accelerate renewable energy adoption by anticipating better energy demand, better forecasting of weather conditions, better grid management or better prediction of infrastructure maintenance needs. AI is key to making sure decentralized energy sources send excess electricity to the grid while utilities direct power to where it’s needed. The same dynamic holds for energy storage with industrial facilities or office buildings.

With solar costs declining over 85% during the past decade, price competitiveness is a key factor. The geopolitical consequences of the Ukraine invasion will accelerate permit allocation to increase efficiency, and the European Union has a plan called REPowerEU, which targets independence from Russian fossil fuel before 2030. Solar capacity should more than triple to 200 gigawatts by 2030 and onshore wind capacity should double by 110 gigawatts; offshore wind is expected to triple to 30 gigawatts.

There will be strong demand for Chinese solar and wind manufacturers. Innovation in battery storage and cable technologies will remain critical, especially given increased costs in some materials needed to manufacture them. There are incredible investment opportunities along the supply chain, in producers and service companies.

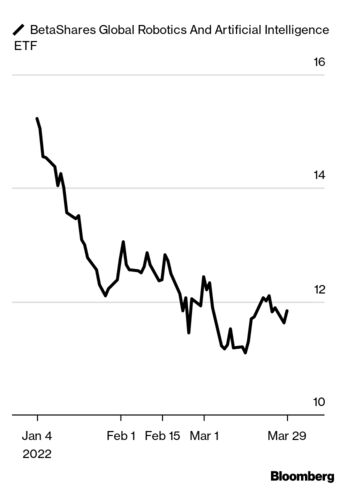

covers Chinese electronics, software and machinery, and has a 0.68% management fee, Bloomberg Intelligence’s Sin said. For a more global exposure, try BetaShares Global Robotics and Artificial Intelligence (RBTZ AU)

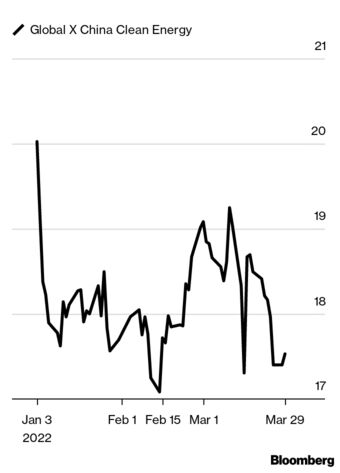

covers Chinese electronics, software and machinery, and has a 0.68% management fee, Bloomberg Intelligence’s Sin said. For a more global exposure, try BetaShares Global Robotics and Artificial Intelligence (RBTZ AU) , which charges 0.57% and has exposure to the U.S., Japan, Switzerland and Norway. For Chinese solar and wind, Global X China Clean Energy (9809 HK)

, which charges 0.57% and has exposure to the U.S., Japan, Switzerland and Norway. For Chinese solar and wind, Global X China Clean Energy (9809 HK) has a 0.68% management fee and a one-year return of 32%, thanks to the Chinese government’s support of ESG-friendly policies, she said.

has a 0.68% management fee and a one-year return of 32%, thanks to the Chinese government’s support of ESG-friendly policies, she said.

2021 Q4

We start with a macro thematic approach to investing, blending geopolitical analysis, macroeconomic trends and policy insights from the ground to nail down our views. There are three trends that excite us today in Asia. First, we think that foreign investors are souring on China at precisely the moment when investing in the country may be becoming easy. The Chinese Communist Party is offering you a sectoral asset allocation for free: long “hard tech” and short “soft tech.” Think of the “Xi put” as this decade’s “Greenspan put.”

Second, by hard tech, China means semiconductors, 5G, green or sustainable tech, industrials, materials and energy. The shift is not exclusive to China, either. In Japan, we are particularly interested in all things related to sustainability and green tech. Japan stands to profit from the global Race to Zero — the United Nations-backed push for countries to achieve net-zero carbon emissions as soon as possible — due to its lead in semiconductors, advanced materials and tech hardware.

Third, sentiment in China is particularly focused on the race to build the metaverse. While in the West, uttering “the metaverse” is likely to get you laughed out of the boardroom, in China it is seen as the next technological frontier. The way to invest on this theme is to buy advanced semiconductor companies — especially those doing a lot of capital expenditure — VR or AR manufacturers and global gaming companies.

To profit from Beijing’s turn to “hard tech,” investors could buy the KraneShares SSE STAR Market 50 Index ETF (KSTR US) or the KraneShares CICC China 5G and Semiconductor Index ETF (KFVG US). To play “Green China, Inc.” there’s the KraneShares MSCI China Clean Technology Index ETF (KGRN US) or the VanEck Vectors ChinaAMC SME-ChiNext ETF (CNXT US). We recommend a custom basket of companies for the “Japanese Race to Zero” thesis. The only ETF playing the theme is the Global X CleanTech ESG Japan ETF (2637 JP), but it’s only available on the Tokyo Stock Exchange.

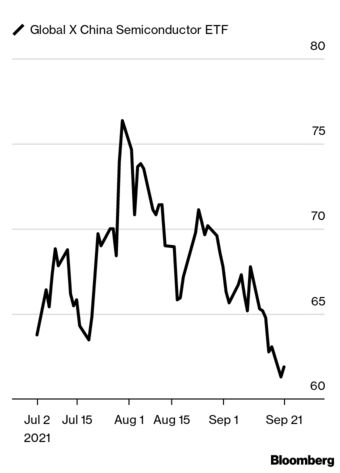

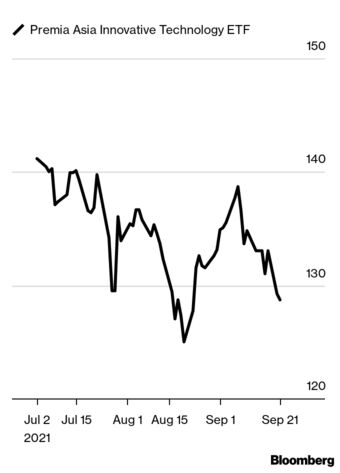

could be an alternative to some of the ETFs above, with a management fee of 0.68% and $215 million in assets, said Bloomberg Intelligence ETF analyst Rebecca Sin. The ETF is up about 12.5% so far this year. To incorporate all the themes, you won’t find a cheaper ETF than the Premia Asia Innovative Technology ETF (3181 HK)

could be an alternative to some of the ETFs above, with a management fee of 0.68% and $215 million in assets, said Bloomberg Intelligence ETF analyst Rebecca Sin. The ETF is up about 12.5% so far this year. To incorporate all the themes, you won’t find a cheaper ETF than the Premia Asia Innovative Technology ETF (3181 HK) , with a management fee of 0.50%, said Sin. The ETF has exposure to everything from robotics, 5G, automation and semiconductors to e-sports and life science. Chinese technology ETFs have attracted more than $11 billion for the year to date, a 53% jump compared to 2020. The semiconductor sector has seen a surge in usage from mobile phones to electric vehicles and this trend is expected to continue.

, with a management fee of 0.50%, said Sin. The ETF has exposure to everything from robotics, 5G, automation and semiconductors to e-sports and life science. Chinese technology ETFs have attracted more than $11 billion for the year to date, a 53% jump compared to 2020. The semiconductor sector has seen a surge in usage from mobile phones to electric vehicles and this trend is expected to continue.

Over long periods of time it’s generally a winning strategy to have your portfolio a little more in things that are priced reasonably and a little less in investments that have high prices. Right now, valuations on Asian equities are more reasonable relative to the U.S., with, for example, the price-earnings ratio on the SPDR S&P 500 ETF (SPY) around 29, and the PE on the iShares MSCI China ETF (MCHI) at 14.

I’ve had an interest in smaller company stocks for a long time, probably because I’m an entrepreneur and appreciate all the intangible things a small-business mindset brings to the table. Some of the financial ratios on growth companies that are on the smaller side can look a little absurd, but if you treat things like joint venture partners, customer relationships, the energy of the founder and the team as assets, some of these companies are quite reasonably valued.

One company I like in China is Uxin, which sells used cars. It’s like the Carvana of China. The service is similar to those we’ve seen in the U.S, with more transparency about where the car has been and how it works. Uxin has a great inventory system, the quality of cars has become better, and they’ve taken out some of the financing risk by using third-party financing companies. With this company, you’re getting a little closer to the local economy and used cars is an area that’s very important in China.

In Japan, a company called CrowdWorks has some good demographic tailwinds. It’s an online platform designed to appeal to gig workers, telecommuters and those who work from home, and it has 4.5 million workers in its client base. It has potential when you think about the future of work. There’s room for a bunch of these businesses in Japan, and someone in Japan would be more likely to work with CrowdWorks than with companies like Israel-based Fiverr or U.S.-based Upwork.

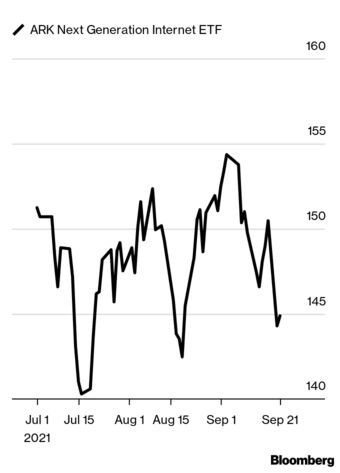

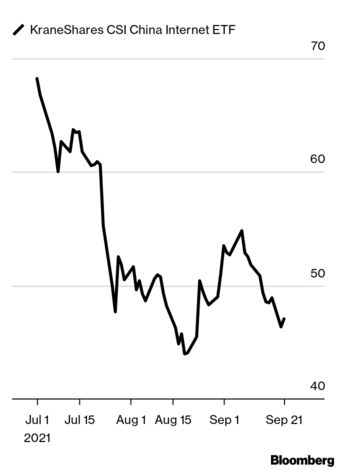

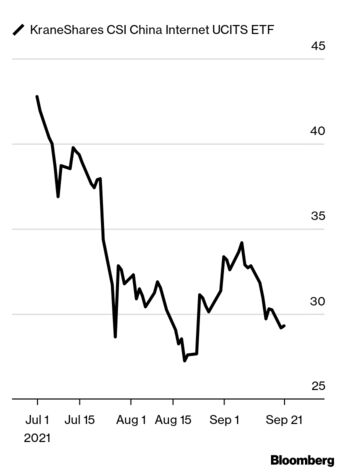

, an actively managed ETF with a 0.75% expense ratio and almost $5.5 billion in assets, focuses on everything that generates business through websites, from hardware to software, said Bloomberg Intelligence’s Sin. An alternative that tracks Chinese internet and internet-related sectors is KraneShares CSI China Internet (KWEB US

, an actively managed ETF with a 0.75% expense ratio and almost $5.5 billion in assets, focuses on everything that generates business through websites, from hardware to software, said Bloomberg Intelligence’s Sin. An alternative that tracks Chinese internet and internet-related sectors is KraneShares CSI China Internet (KWEB US or KWEB LN

or KWEB LN ), with a 0.73% management fee and almost $7 billion in assets.

), with a 0.73% management fee and almost $7 billion in assets.

There are a lot of opportunities in logistics and supply chain companies. I was well aware of the friction points when I was growing up in the Philippines. The Philippines has about 111 million people spread across a huge archipelago of over 7,100 islands. Not every island is occupied, but there are people in some parts of the country that still require a lot of supply and logistics support.

We’ve invested in a company called Growsari, which uses mobile technology to cut costs and save time for small business owners. In the Philippines there’s this phenomenon of sari-sari stores — they’re like a rural version of a 7-Eleven. Before, sari-sari owners had to travel to major urban centers and rely on intermediaries to procure goods. That meant manufacturers and distributors were getting big margins, but sari-sari stores weren’t. Growsari helps such stores digitize their businesses, and procures wholesale inventories, which is great for the stores’ margins. The company has sights to expand beyond the Philippines.

Aquaculture is another compelling investment area. If you overfeed fish they can die, and you’re not optimizing your harvest. In Indonesia, companies are using sensors to detect certain behaviors that fish exhibit when they’re hungry. When the technology senses that behavior, it releases just the right amount of food into the ecosystem. We are looking for these types of emerging-markets solutions where technology can really improve the way agriculture works and can be used to cut costs.

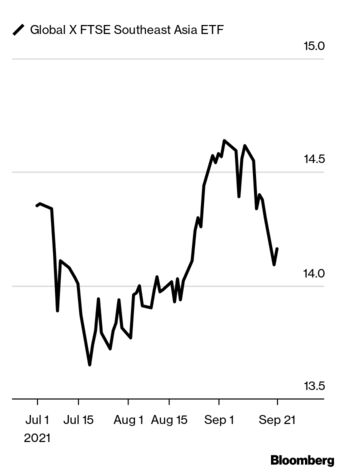

, with a management fee of 0.50% and about $36.6 million in assets, covers Indonesia, Malaysia, Philippines, Thailand and Vietnam, said Bloomberg Intelligence’s Sin. The ETF represents 100 of the leading companies across financials, consumer staples, industrial and communication services. Global X FTSE Southeast Asia (ASEA US)

, with a management fee of 0.50% and about $36.6 million in assets, covers Indonesia, Malaysia, Philippines, Thailand and Vietnam, said Bloomberg Intelligence’s Sin. The ETF represents 100 of the leading companies across financials, consumer staples, industrial and communication services. Global X FTSE Southeast Asia (ASEA US) , with a 0.65% fee and almost $34.2 million in assets, is another alternative, Sin said.

, with a 0.65% fee and almost $34.2 million in assets, is another alternative, Sin said.

When it comes to China’s technology sector, in the last 12 months the market has gone from excessively optimistic to excessively pessimistic. When stocks correct so much, there is a favorable risk-reward calculation as you are getting in at the lower end of five-year average values.

Growth rates are going to slow down as companies like Meituan pay more in terms of social obligations to their drivers, yet those costs can eventually be passed on to the end consumer. It’s a similar story with Alibaba. While we’ve seen e-commerce penetration plateauing, if you believe in the Chinese consumption story the stock is attractive, particularly at a single-digit multiple.

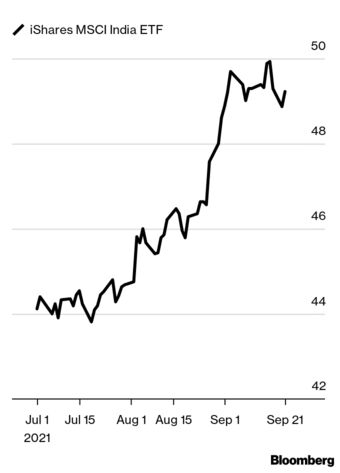

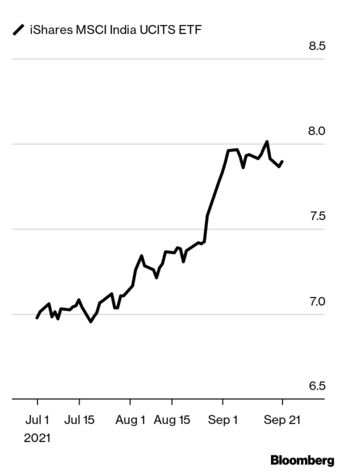

India is also promising. Prime Minister Narendra Modi has improved the climate for investing in the country, with reduced tax rates and production incentives. After Covid dislocations, most companies are now looking at a China-plus one strategy for suppliers as they’ve realized having 60 to 80% of products sourced from China is not something that can happen for the next decade.

Despite the big loss in terms of life that Covid took in India, the economy is rebounding well. We are positioned for a cyclical recovery and own things like banks and industrials. Part of our evergreen exposure is on the consumption theme. Covid has expedited the adoption curve of companies such as Zomato, India’s leading home delivery company. New habits are forming, which is something we as investors often underestimate. Valuations aren’t cheap, but for a certain portion of our portfolio as long as we like the opportunity and the management, we’re prepared to overlook valuations because the stocks will grow into them.

Vietnam is a similar story, but at one-third of the valuation, with long-term structural drivers of growth in urbanization picking up, income growth and great companies. We like Phu Nhuan Jewelry, the country’s leading mass-market jeweler. PNJ is gaining share from independent jewelers, which account for 70 to 80% of the market and also benefits from Vietnamese women starting to prefer diamonds over plain gold jewelry.

, which has 45% of the portfolio in those three names. This ETF, with a 0.65% management fee, focuses on 30 of the largest global listed Chinese internet companies. To gain exposure to India, try iShares MSCI India (INDA US)

, which has 45% of the portfolio in those three names. This ETF, with a 0.65% management fee, focuses on 30 of the largest global listed Chinese internet companies. To gain exposure to India, try iShares MSCI India (INDA US) , which has $6.4 billion in assets and a fee of 0.69%, or the UCITS version (NDIA LN)

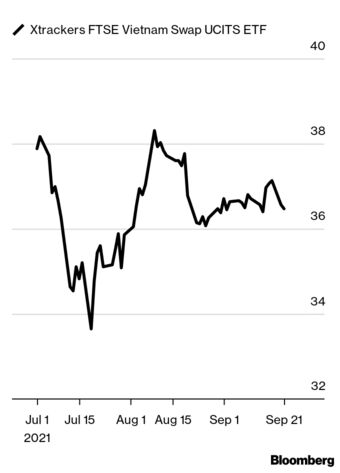

, which has $6.4 billion in assets and a fee of 0.69%, or the UCITS version (NDIA LN) , which has a return of around 25% year to date, with almost 50% of assets in computers, diversified financial services, oil and gas, and banks. For Vietnam, Xtracker FTSE Vietnam Swap UCITS (XFVT GR)

, which has a return of around 25% year to date, with almost 50% of assets in computers, diversified financial services, oil and gas, and banks. For Vietnam, Xtracker FTSE Vietnam Swap UCITS (XFVT GR) , with $395 million in assets and a fee of 0.85%, has about 20% in consumer staples, and a year-to-date return of 30.3%.

, with $395 million in assets and a fee of 0.85%, has about 20% in consumer staples, and a year-to-date return of 30.3%.

The Asia-Pacific region isn’t going to follow the same development path as today’s rich countries. Our mindset investing in Asia shouldn’t be: “When will Asia catch up with the West on this metric?” It should be: “What will the Asian path be?”

We see the most attractive investment opportunities in companies benefiting from tailwinds in the shift towards more sustainable development.

One example is Vitasoy. It’s based in Hong Kong and derives the vast majority of its sales in China. If you look at the dairy industry globally, greenhouse gas emissions account for more than aviation and shipping combined. The biggest driver of that in the future will be consumption in Asia. Consumption in China is forecast to triple over 30 years. Every liter of plant-based milk or every gram of tofu that Vitasoy sells in China displaces a material volume of emissions. China is not self-sufficient in dairy in part because its traditional dairy regions in inner Mongolia are subject to desertification and water shortages. Milk consumes 20 times as much water, so alternatives like Vitasoy will be better placed in the future.

Usually our portfolios have a much greater exposure to India and a much lower exposure to China. That’s not because of any view on macro-economics or politics, but it’s simply where we can find high-quality private businesses benefiting from sustainability tailwinds. In India getting access to the sort of detailed information on a company we need as bottom-up investors is also easier.

One investment in India is housing finance company Housing Development Finance Corp. Around half of HDFC’s loans are to new homeowners and around a third of its loans are in the affordable loan segments. Across Asia and emerging markets, there are hundreds of millions of people who don’t have adequate housing, and the biggest single reason for that is lack of access to finance. So a company in which the business model is linked to helping plug that gap in a way that is responsible and balances the needs of stakeholders delivers historically fantastic returns.

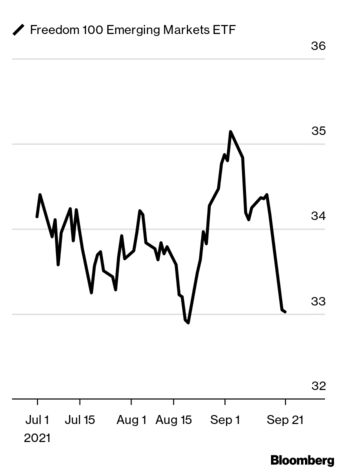

, with a 0.49% management fee and $89 million in assets, which screens out authoritarian emerging market regions, said Bloomberg Intelligence’s Sin. This ETF ranks regions based on civil, political and economic freedom, with top regions being Taiwan, South Korea and Poland. It has zero exposure to China, Russia, Saudi Arabia, Turkey and Egypt. Another possibility: iShares MSCI Emerging Market ex-China (EMXC US)

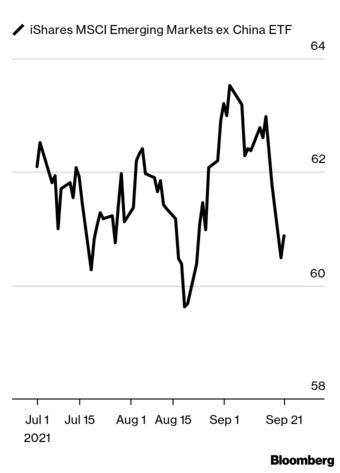

, with a 0.49% management fee and $89 million in assets, which screens out authoritarian emerging market regions, said Bloomberg Intelligence’s Sin. This ETF ranks regions based on civil, political and economic freedom, with top regions being Taiwan, South Korea and Poland. It has zero exposure to China, Russia, Saudi Arabia, Turkey and Egypt. Another possibility: iShares MSCI Emerging Market ex-China (EMXC US) , with a 0.25% management fee and $1.3 billion in assets. Almost 18.4% of the portfolio is in India, and more than $1 billion has flowed into the ETF for the year to date.

, with a 0.25% management fee and $1.3 billion in assets. Almost 18.4% of the portfolio is in India, and more than $1 billion has flowed into the ETF for the year to date.