Supply chains are complicated. But if you’re wondering why everything you want to buy seems to be stuck in a global traffic jam these days, the answer is relatively simple, says Karen Kancens, vice president of the Shipping Federation of Canada.

“There’s been a surge in demand for imported containerized goods,” she says.

As we all got stuck at home in the first wave of the pandemic in 2020, we started buying more “things.” Instead of spending on restaurants and gym subscriptions, we started ordering, say, baking gear and dumbbells to work out in the living room. Globally, consumer demand shifted away from services and toward manufactured products.

Exports from Asia, which manufactures many of the products consumers are buying in the pandemic, will be nearly 15 per cent higher by the end of this year than they were in 2019, the World Trade Organization predicts.

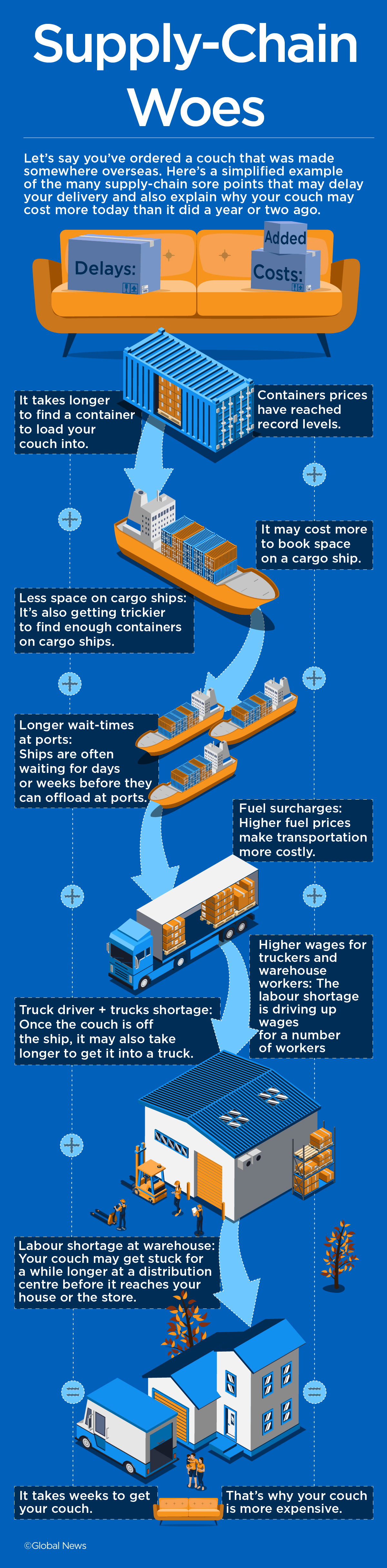

More than a year later, that surge in demand has yet to let up and is clogging supply chains around the world, says Kancens. From finding components through loading products into containers and onto cargo ships, trains or trucks to warehouses and distribution centres, “all those touchpoints along the chain are … congested,” she says.

For consumers, the supply chain logjams don’t just mean emptier store shelves, “out of stock” signs or frustratingly long delivery times. They also mean price increases, as manufacturers and retailers pass the higher costs they’re facing due to supply delays and shortages onto shoppers.

Here’s how the COVID-19 pandemic is exposing the vulnerabilities of the world’s logistics networks.

How did we get here?

Supply chains should be able to handle large volume upswings, says Kancens. But they also have to be able to operate efficiently in normal times.

Building logistics systems that can manage sudden spikes while otherwise remaining nimble isn’t easy, she says.

But what supplier networks around the world have been facing during the pandemic isn’t just a massive jump in demand for consumer goods, it’s an increase that’s been lasting for over a year, Kancens notes.

Despite loosening COVID-19 restrictions, the surge in e-commerce orders shows no sign of letting up, says Laurie Tannous, special advisor to the Cross-border Institute at the University of Windsor and vice president of government relations at Farrow, a customs broker and logistics provider.

It doesn’t help that while global demand for consumer goods and manufacturing inputs bounced back quickly after the onset of COVID-19 and soared past pre-pandemic levels, suppliers and shippers struggled to ramp up activity.

As lockdowns spread from Asia to Europe and then North America in the early months of 2020, both manufacturers and transportation service providers drastically scaled back capacity, Kancens and Tannous note.

By the summer of 2020, things were looking up, and consumers were ordering everything from patio furniture to standing bikes – anything that would make housebound pandemic life a little less dreary.

But while placing an order online takes little more than a click of the mouse, factories and transportation firms had to call back staff and work with COVID-19 safety protocols, among many other issues.

“When you reduce capacity, you’re laying off workers, you’re doing various things. You don’t just get those things back overnight,” Kancens says.

The fact itself that many factories re-started at the same time after weeks of idling contributed to creating supply-chain clogs, Tannous says.

“All those goods are trying to get on containers at the same time,” she says.

Shipping containers, meanwhile, weren’t where they were supposed to be. By the spring of 2021 factories in Asia were humming away making products and parts to be shipped abroad. Containers loaded with exports from Asia headed out to Europe and North America, but because much of the rest of the world was still implementing strict COVID-19 restrictions, “those containers did not come back quickly enough,” according to a report by logistics company Hillebrand.

But even without the issue of containers sitting empty on the wrong side of the supply chain, it’s become clear there simply aren’t enough giant steel boxes for all the stuff that’s supposed to crisscross the globe right now, according to Tannous.

A shortage of everything

Containers are just one of the shortages supply chain managers are trying to work around right now.

The same supply-demand mismatch that has affected all kinds of manufacturing inputs and consumer products has also impacted commodities like lumber and steel. Meanwhile, inclement weather in many parts of the world has also resulted in shortages of agricultural products like wheat.

A similar narrative holds for energy resources. As COVID-19 restrictions loosen again and economic activity around the world picks up speed, demand for fuels like gasoline, diesel and natural gas has increased fast. But in some cases, the uncertainties of the global pandemic have made producers reluctant to make significant capital investments in new drilling programs.

When it comes to natural gas, for example, high demand is running up against unusually low inventories. This, combined with other factors, is driving prices to record levels, especially in Asia and Europe.

And permeating virtually every aspect of the supply chain is a shortage of people. Employers around the world have been struggling to find enough workers to fill available jobs, especially in lower-paying jobs that may present a higher risk of COVID-19 contagion.

The pandemic has also triggered a wave of early retirements in a number of sectors. Canada’s trucking industry, for example, is facing an estimated shortage of around 20,000 drivers. To put that in context, the number of drivers handling all of the Canada-U.S. cross-border trade comes to about 160,000, says Stephen Laskowski, president of the Canadian Trucking Alliance.

“Not only did we have a shortage of drivers prior to the pandemic, we had one of the oldest demographics in our workforce,” Laskowski says.

Similarly, some major international ports have been struggling to find enough labour to offload ships, and warehouse workers are also in short supply, Tannous says.

All the shortages are creating delays that cascade and compound through the supply chain ultimately resulting in emptier shelves or extra long delivery times, she adds.

How supply chain woes are driving up prices

The shortages and backlogs aren’t just creating delays. They’re also pushing up costs.

Container prices, for example, have reached record levels. The average cost of shipping a container from the Asia Pacific region, which makes up nearly 70 per cent of monthly shipping volume to North America, rose by 63 per cent between March and July, write RSM economists Tuan Nguyen and Joseph Brusuelas. The cost of sending a container from Europe increased even more — by nearly 80 per cent — in the same period.

Tannous says she’s heard from clients who’ve seen the cost of a container skyrocket from $2,500 to a mind-boggling $25,000.

The energy crunch, meanwhile, is translating into fuel surcharges for transport via both ship and truck, say Kancens and Laskowski. But higher energy prices are also making it more expensive to operate many factories and farms, further driving up production costs.

In addition to container and fuel prices, companies are also finding that freight rates are climbing, Kancens says.

To circumvent the global transport backlog, some retailers like Ikea Canada and Walmart in the U.S. are buying their own containers or chartering their own vessels. Those kinds of emergency solutions are also likely introducing extraordinary costs for companies, Tannous says.

And finally, there are wages. Employers who are struggling to fill vacancies are increasing pay in an effort to lure in new workers, Tannous adds.

It all feeds into massive cost increases that companies are increasingly willing to pass on to consumers. In Canada, inflation hit 4.4 per cent in September, the highest level since 2003. In the U.S. it edged up to 5.4 per cent in the same month, a 13-year high.

Eventually, the pricey gridlock will clear our, according to Tannous. Some consumers will give up on buying goods that seem perennially delayed or out of stock, while companies will figure out better workarounds, she says.

But it will take time, she adds.

“I think probably at some point halfway through 2022, we’re going to see some resolution.”

Comments