A budget shortfall was talked about at Calgary City Hall on Tuesday.

The city released the 2020 adjustments to “One Calgary Service Plans and Budgets.”

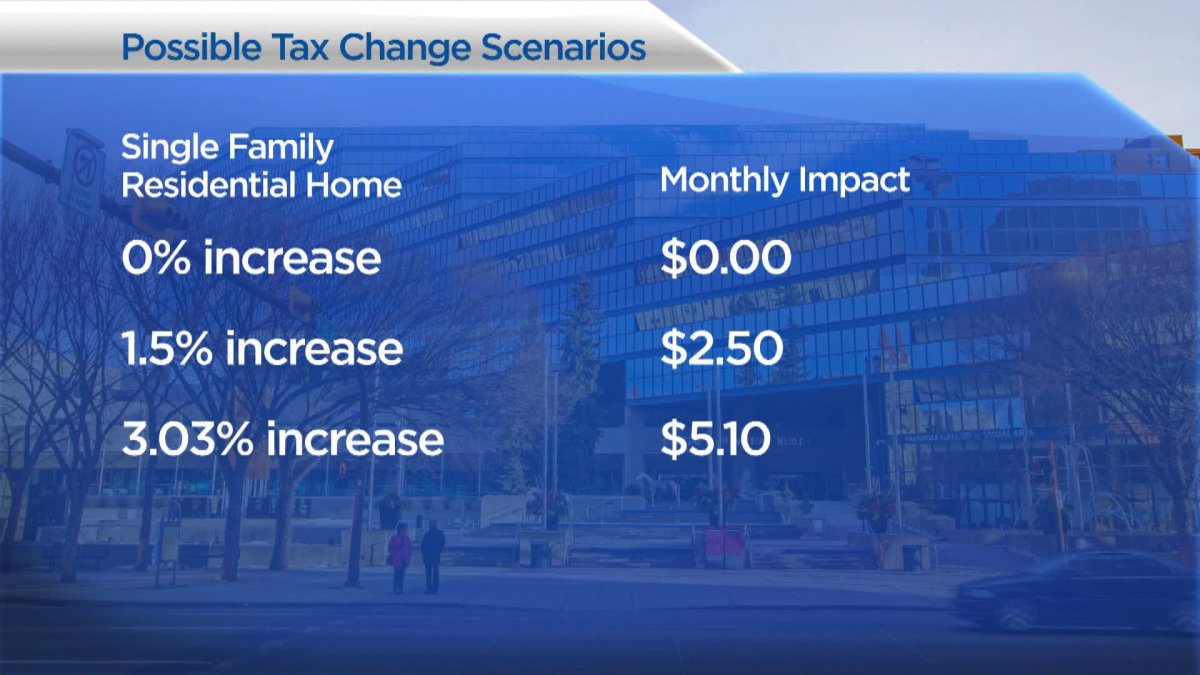

Ahead of budget week, city council is reviewing possible scenarios that involve either freezing the current tax rate and cutting services or increasing taxes and maintaining services.

There are three possibilities being considered when it comes to property taxes: no change at all, a 1.5 per cent increase ($2.50 more a month for per single family home) or a 3.03 per cent increase (about $5 more per single family home).

As directed by council on July 16, 2019, administration prepared two reduction scenarios to tax-supported services as part of the 2020 adjustments.

One outlines the impacts of a tax increase of 1.5 per cent for 2020 and the other outlines the impacts of an overall tax freeze. These scenarios are seen as potential alternatives to the 3.03 per cent increase for 2020 that had been previously approved as part of the 2019-2022 One Calgary Service Plans and Budgets.

The majority of councillors have expressed that they are in favour of a 0 per cent increase. If council chooses that scenario, then $52 million will need to be to cut from the operating budget.

- Alberta to overhaul municipal rules to include sweeping new powers, municipal political parties

- Norad looking to NATO to help detect threats over the Arctic, chief says

- Grocery code: How Ottawa has tried to get Loblaw, Walmart on board

- Canada, U.S., U.K. lay additional sanctions on Iran over attack on Israel

That would mean cutting 236 full-time city jobs and the police service would also need to reduce its costs by $8.4 million. Such a move would also see the fire department need to trim $3.2 million.

Without an increase to property taxes, community partners could also be hit hard. The Calgary Zoo would lose close to $250,000 in funding, Heritage Park would lose more than $100,000 and Telus Spark would see a loss of about $64,000.

Fees for pools and skating rinks would also go up.

READ MORE: Calgary city council told about impacts of provincial budget

Mayor Naheed Nenshi said whichever scenario gets picked, Calgary still has the lowest residential tax rate in the country.

“So we have to make sure that we are not being penny wise and pound foolish,” he said. “We have to make sure that we’re not making cuts that hurt our competitiveness, our ability to attract business, our ability to fill the downtown. This is really really critical.

“Throughout the budget debate, you’re going to hear me say a lot, ‘Alright, is that cut going to hurt us in the long run? Does that save people five cents a month today but actually prevent our ability to fill 300,000 square feet downtown?'”

But the zero per cent scenario could potentially not mean zero if council looks to give non-residential ratepayers (businesses) a break. Tax shift talks concerning residential and non-residential ratepayers continue with council and could affect tax rates heading into the budget debate.

READ MORE: Alberta Budget 2019: Deferred provincial funding puts Calgary’s Green Line LRT ‘in jeopardy’

Comments