It has been expected for some time, but today the Justice Department and eight states are suing Google over its purported domination of the online advertising market. The government has a problem with Google's position in "ad tech," or the tools used to automatically match advertisers with website publishers. To solve it, apparently, the DOJ has told Google it's considering breaking the company up.

“Today’s complaint alleges that Google has used anticompetitive, exclusionary, and unlawful conduct to eliminate or severely diminish any threat to its dominance over digital advertising technologies,” said Attorney General Merrick Garland. “No matter the industry and no matter the company, the Justice Department will vigorously enforce our antitrust laws to protect consumers, safeguard competition, and ensure economic fairness and opportunity for all.”

The press release gives a quick rundown of the DOJ's list of Google’s anticompetitive conduct:

- Acquiring Competitors: Engaging in a pattern of acquisitions to obtain control over key digital advertising tools used by website publishers to sell advertising space;

- Forcing Adoption of Google’s Tools: Locking in website publishers to its newly acquired tools by restricting its unique, must-have advertiser demand to its ad exchange, and in turn, conditioning effective real-time access to its ad exchange on the use of its publisher ad server;

- Distorting Auction Competition: Limiting real-time bidding on publisher inventory to its ad exchange and impeding rival ad exchanges’ ability to compete on the same terms as Google’s ad exchange; and

- Auction Manipulation: Manipulating auction mechanics across several of its products to insulate Google from competition, deprive rivals of scale, and halt the rise of rival technologies.

Google is the US's largest digital ads broker, but not by much. Axios reported that Google has 28.8 percent of all US digital ad spending, followed by Meta at 19.6 percent. Many other companies also have growth potential, like Amazon, TikTok, Spotify, and Apple, but for now, those companies tend to only focus on their specific platforms.

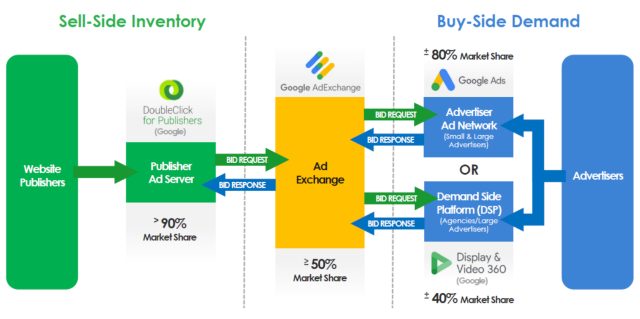

It's not the overall market share that the DOJ is worried about, though: It's the market share of the individual tools used by publishers and ad companies. On the "sell side" (the side of websites that have ad space to sell—like this one), the DOJ says Google's "DoubleClick for Publishers" ad server has an over 90 percent market share. On the "buy side" (the side of advertisers that are looking for a spot for their ads), the Google Ads network for smaller businesses has an 80 percent market share, while "Display & Video 360" for big ad agencies has a 40 percent market share. The Google Ad exchange, which matches sellers and buyers, has a 50 percent market share.

As for a solution, the DOJ says, "To redress Google’s anticompetitive conduct, the Department seeks both equitable relief on behalf of the American public as well as treble damages for losses sustained by federal government agencies that overpaid for web display advertising. This enforcement action marks the first monopolization case in approximately half a century in which the Department has sought damages for a civil antitrust violation." Basically, it wants Google to pay back money.

Google published a blog post stating it disagrees with the government's latest antitrust lawsuit. After the usual spiel about how the market is more competitive than the plaintiff thinks, it adds a new threat that isn't mentioned in the press release, saying, "DOJ is demanding that we unwind two acquisitions that were reviewed by US regulators 12 years ago (AdMeld) and 15 years ago (DoubleClick). In seeking to reverse these two acquisitions, DOJ is attempting to rewrite history at the expense of publishers, advertisers, and Internet users."

It's hard to believe Google would ever be broken up. We hear the threat fairly often, but the last time the government broke up a company was nearly 40 years ago. Back then, the phone company, Bell Systems, was split into what would eventually become AT&T, Verizon, and Lumen Technologies/CenturyLink/Qwest. The US government's desire to regulate companies has declined greatly since then, and today the threat is usually just a negotiation starting point.

In the run-up to this lawsuit, last year Google told the DOJ it would be willing to "split up" the ad business by moving one unit from Google to its parent company, Alphabet. That's a move that seems like it would barely register, when Google and Alphabet have the same CEO, CFO, and stock ticker and all share the same (very big) money pile.

reader comments

110