Mr. Monopoly, that mustachioed fat cat with the Taftian profile, was about as close as most Americans got to a New York City billionaire until candidate Donald Trump started flying his jet to their cities and villages last year. Now they are practically an everyday sight, because President Donald Trump has coaxed a pack of them out of their penthouse triplexes, yachts and private jets to either join his Cabinet or sit on his councils and advisory boards. Trump voters know they've had a government for billionaires—that's one reason they're so mad—but to have one by billionaires means the Mighty Oz is now setting the nation's agenda, and there is no curtain.

Anybody with $1 billion in net worth possesses a tranche of wealth greater than the gross domestic product of 60 nations. So what can a president give to these men who have everything? And what can they do for him and to the rest of America? The answer may be found in the most famous line from the Italian classic novel The Leopard, about the decaying Sicilian aristocracy: "Everything must change so that everything can remain the same." The best gift Trump can give his rich friends from Manhattan is to appear to be shaking up the system while leaving their myriad tactics for manipulating and amassing capital unaffected by federal regulation and higher taxes. Less than three months into his presidency, Trump is well into that agenda—quietly deregulating the financial industry, stripping Barack Obama's climate change rules from fossil fuel producers and promising to lower taxes on the very rich.

A billionaires' takeover of the U.S. government was not one of Trump's signature campaign promises, but in retrospect it was obvious he wasn't going to bring in the sustainability MBAs—he doesn't know any. Instead, he set up a government of, by and for his peers (or men the famously insecure Trump wishes to call his peers). His Cabinet of millionaires and billionaires is the richest in American history. The New York billionaires, though, have more in common with Russian oligarchs and Nigerian petro-magnates than with almost any other Americans—whether they are flipping burgers at McDonald's or performing heart surgery at the Mayo Clinic. They have been sold to the public as men who will help Trump run the country "like a business," in which the public is the consumer. After careers in which they put growing their colossal bank accounts ahead of the interests of small towns, working stiffs and the common weal, there is no reason to believe they will worry about how predatory lending or letting Obamacare "explode" affects real people. Trump's billionaires are not government-hating ideologues like the Koch brothers or mega-donor Robert Mercer. They are more like what Trump used to be—unaffiliated centrists. And their agenda—and now the country's agenda—is defined by those matters that affect their wallets.

Pity the Poor, Misunderstood Billionaire

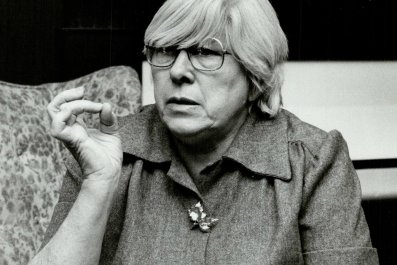

"The rich aren't rich anymore," says society writer David Patrick Columbia. "My friend inherited hundreds of millions. She said to me, 'I'm not rich anymore.' They didn't lose their money, but these other people make billions—some of them make a billion dollars a year. And that's all they really care about. All those guys love talking about how much money they have. It's what they like to do."

Most of the billionaires Trump has lured to D.C. are, like him, members of the 1980s generation of leveraged-buyout tacticians, junk bond kings, corporate raiders and vulture capitalists. They got rich off of emerging financial tactics crafted to take advantage of Ronald Reagan's great gift to Wall Street—ripping up the regulations put in place after the Great Depression. Trump adviser and corporate raider Carl Icahn (net worth $16.6 billion) is said to have been a model for Michael Douglas's "Greed is good" character in Wall Street. Commerce Secretary Wilbur Ross ($2.5 billion), policy adviser Stephen Schwarzman ($11.8 billion) and unofficial intel adviser Stephen Feinberg ($1.2 billion) all made their fortunes in the kind of investment banking that came into vogue after Wall Street decreed that social responsibility and business—the Jimmy Stewart banker model—were antithetical.

The New York real estate developers now advising the president—Steven Roth (net worth $1.1 billion) and Richard LeFrak ($6.5 billion)—spent their professional lives (as did Trump) in a mosh pit with politicians, city regulators, 50-story crane operators, cement mobsters and the motley crew of characters, unsavory and otherwise, responsible for the New York skyline and the surrounding area's malls, golf courses and housing developments.

Whether they earned their money in investment banking or New Jersey strip malls and high rises, Trump's billionaires have much in common with the rest of the New York's 1 percent. They don't pay much in taxes, and most don't think they should pay much more. They loathe government regulations, and they are ferociously competitive. "They all know each other. They finance each other. And they all compete with one another," says Holly Peterson, journalist, author of It Happens in the Hamptons and daughter of Peter Peterson, one of the New York billionaires who is not in Trump's camp. "They sniff each other like dogs."

But none of them are—again, like the president—burrowed into New York high society. In 1983, when Paul Fussell wrote his book Class: A Guide Through the American Status System, examining class in the U.S. from top to bottom, he described how one sign of top status was inherited wealth, and another the discreet display of that wealth. Those rules don't apply anymore, at least not in New York society. Trump and his billionaires are elaborately and publicly rich, and while some of their dads were wealthy, they didn't all start out that way. Schwarzman, the chairman of Trump's Strategy and Policy Forum, is the son of a Pennsylvania dry goods store owner, and he now divides his time between a 37-room Park Avenue triplex, a Hamptons estate and villas in Palm Beach, Florida, and Jamaica. He is famous for blowing millions on his birthday bashes. Icahn went to a public high school in Far Rockaway, long before he bought himself a 177-foot yacht.

With the exception of Ross and his $250 million art collection, they aren't aesthetes—even if their names are sometimes chiseled into the granite of gracious old public properties like main building of the New York Public Library (Schwarzman) or embossed in brass on the soaring buildings that house their companies. Trump famously smashed precious historic Bonwit Teller building's architectural elements—coveted by the Metropolitan Museum of Art—to bits because to preserve them would have delayed work on Trump Tower by two weeks. Roth once left a massive eyesore of a hole in midtown Manhattan for nearly 10 years at the site of a department store he'd bought and demolished, in part to gain more city incentives to develop it.

New York billionaires are sometimes known for their noblesse oblige or devotion to civic causes, but not this crew. They are social-circuit philanthropists. Former Mayor Michael Bloomberg (the eighth richest man in the world, net worth $47.8 billion) invested his name and money advocating for gun control and famously pushed for a more environmentally friendly New York City while he was in office. New York billionaire Peter Peterson, Schwarzman's former partner, put $1 billion into an economic think tank. And, along with Bill Gates, Warren Buffett and 40 other billionaires, he signed the Giving Pledge, in which all promised to donate the majority of their wealth to charity. Schwarzman gave the New York Public Library $100 million, but only after being mocked a month before in The New Yorker for stinginess. ("He has given, but not remotely what he could," sniffed one anonymous critic in that article.) Financial writer James B. Stewart has described how Schwarzman had trouble booking a prime table in the Grill Room at the Four Seasons, a high-society lunchtime scene. Schwarzman asked his then-partner, Peterson, about it, who explained, "It takes more than just money."

Trump's billionaires, while the richest men in New York City, are a tier below the cultural-financial establishment, the aristocracy. "I think the nature of all these guys is that they are not a part of a power or moneyed establishment," says one Manhattan private equity investment banker who knows most of them. "You can be very, very rich without being terribly important here. It's not like [Trump] has assembled a cabal of pathbreakers who disrupted the 21st century."

They have been disruptors of another sort—as vulture capitalists or, more euphemistically, investors in distressed companies. Icahn was one of the first corporate raiders, and he invented "greenmail," a now-outlawed 1980s practice in which big New York money would swoop in, buy up a block of stock, then force a company's board to buy it back or risk a takeover. Among his many pelts in a career of corporate raiding, Icahn gets credit for killing the airline giant TWA.

Like Icahn, but of a generation younger, Feinberg made his name buying up and reorganizing companies. He founded the ominously named Cerberus Capital (in Greek mythology, Cerberus was the three-headed dog who guarded the gates of hades), which picked apart companies like Anchor Hocking, a glass factory in Ohio, bringing down a small town of Lancaster with it—a community tragedy told in the best-seller Glass House. Feinberg's real passion is weaponry and military contracting; he bought up American gun companies and founded a weapons conglomerate called Freedom Group that, among other offerings, produces automatic weapons favored by the likes of the Sandy Hook school shooter. He also owns a private military training site, and his DynCorp is a leading defense contractor. Feinberg's name is rarely published without the qualifiers "mysterious" or "reclusive." Last year, a corporate spy reported to The New York Observer that Feinberg warned his Cerberus shareholders to stay out of the news. "We try to hide religiously," he said. "If anyone at Cerberus has his picture in the paper and a picture of his apartment, we will do more than fire that person. We will kill him. The jail sentence will be worth it." (None of the billionaires in this story responded to requests for comment, but only Feinberg's office called back and verbally declined.)

New Treasury Secretary Steve Mnuchin (net worth $500 million), though not a billionaire, is another profits-over-people legend. He bought a California bank after the 2008 housing crash, and rehabilitated it by evicting tens of thousands of people, including many elderly and veterans. The subsequent protests—the newly homeless set up camp around his Los Angeles mansion—contributed to the demise of his second marriage.

Retired New York Post society columnist Liz Smith has known Trump since his first marriage, to Ivana, in the 1970s, and she watched New York society at first recoil from him, and then simply give in, as the corporate raiders who became Trump's billionaire buddies took over Manhattan. "The current importance of money and big business and no ethics is discouraging," she says. "In the beginning, the upper crust were all looking at the fact that he was a rich man, and they thought they could extract money from him for their charities. They found out fairly quick he was stingier than they were. I think the billionaires are supporting him with trepidation. They are nervous. They depend on the presidency for stability. They are patriots, most of them. They can't help it if they're rich."

What Do You Give to the Man Who Takes Everything?

Trump's billionaires share his two chief goals: a massive tax overhaul and deregulation, allowing them to make even more money, unimpeded by government intervention. The 99 percent have only the dimmest understanding of the strategies by which the 1 percent operate and profit. To most Americans, for example, bankruptcy is a disaster, a catastrophic credit rating hit, a personal failure and embarrassment suggesting sleeping in one's car or moving back home with mom and dad. For Trump's billionaires, bankruptcy—or as Trump put it, "the chapter laws"—is just another tool in the capitalist box, which includes various legal forms of stock manipulation, shorting pensions, crafting commercial building exchanges to avoid taxes and forcing a distressed or targeted company to buy back its own stock to raise its price.

Another magic trick of billionaire-dom is not paying taxes. Warren Buffett has pointed out that he and other billionaires pay lower taxes than a school teacher. Trump's posse doesn't share Buffett's horror. Trump has avoided paying hundreds of millions in taxes over the years—legally—and so have his billionaires. Trump's administration has made it very clear that it will expand tax benefits for billionaires. Mnuchin promised during his confirmation hearing that "there would be no absolute tax cut for the upper class." But lower taxes for the rich was always behind the Republican rush to repeal Obamacare and replace it with their still-born Trumpcare bill. The nonpartisan Congressional Budget Office estimated the proposal would have left 24 million people uninsured, mostly older and poorer Americans, while giving top earners a $158 billion tax savings on investment income. Trump blurted out the truth in a campaign style speech in Louisville, Kentucky, a week before the plan failed. "We've got to get this done before we can do the other," Trump told the crowd. "In other words, we have to know what this is before we can do the big tax cuts."

Trump's tax overhaul plan, touted as the first real reform in 30 years, remains short on details, but one version gives the top 1 percent of Americans a 6.5 percent tax savings, compared with savings of 1.7 percent or less for middle and lower earners. Trump has promised to kill the alternative minimum tax levied on people like him, when their deductions can zero out their tax bill. According to his 2005 tax bill, Trump was taxed at 24 percent, thanks to the AMT.

The top executives of private equity firms—like Schwarzman, Icahn, Feinberg and, until he divested, Ross—all theoretically qualify for the carried interest deduction, which halves their tax rates. When Obama was stalking the carried interest deduction in 2010, Schwarzman nearly wet himself. "It's a war," he said at a July 2010 board meeting. "It's like when Hitler invaded Poland in 1939." He later apologized.

Special tax deals aren't just for Wall Street tycoons. Real estate magnates like Trump can take advantage of a deduction Congress carved out for them in the 1990s. While average joes who lose money on real estate deals can no longer take full deductions, people who qualify as "real estate professionals" (Trump, LeFrak and Roth) can deduct their losses. Congress also allows developers to deduct the supposed depreciation of their property values over the course of 27 to 40 years, depending on the property type, despite the fact that real estate generally increases in value over time. That means, according to Morris Pearl, formerly managing director at the BlackRock Fund and director of the pro-tax Patriotic Millionaires, developers—and their heirs—never have to pay tax on property. "There are certain things the free market cannot do," he says. "If you prefer a safer society over the long term, you want regulations. But the billionaires have a different perspective on things than other people. If you are Steve Schwarzman and your insurance company goes out of business because of shady deals, you don't need the insurance regulator, you just find other insurance. If you are Steve Schwarzman, you pay about half the amount of taxes as other well-paid New Yorkers. Very few people care about carried interest tax deduction, but Schwarzman thinks he deserves it. Maybe he thinks there is a shortage of people willing to be fund managers, so we need to offer them special tax incentives."

In addition to slashing their tax bills, some of the Trump billionaires have very specific requests and are not shy about expressing them. Special regulatory adviser Icahn is a majority investor in a Texas oil refinery that could have saved $205.9 million last year were it not for the Environmental Protection Agency's renewable-fuel standard, which requires refiners to ensure that corn-based ethanol is blended into fuel. Since Trump's election, Icahn has engaged in a lobbying blitz to change that rule, personally vetting EPA Director Scott Pruitt on it, and urging Trump to dump it.

Trump is also looking to tear up the Dodd-Frank financial reform law with its raft of regulations on the financial industry, and he announced it while sitting beside Schwarzman. Trump referred to discussions with "Steve" about the hated regulatory framework and said he looked forward to Schwarzman's advice on how to improve the economy "for all Americans." He then announced plans to roll back the work of the U.S. Consumer Financial Protection Bureau, which lawmakers passed to protect consumers from predatory lending practices after the '08 crash. He also signed an executive order that set the stage for rescinding the fiduciary rule, ultimately allowing financial advisers to again sell plans to clients that benefit the advisers themselves.

Trump's billionaire boys club is theoretically on board with his anti-globalist stand. Commerce Secretary Ross announced in March that the formal process of renegotiating North American Free Trade Agreement was imminent. He has also announced plans to collect billions of dollars, mainly from China, in fines for breaking U.S. sanctions and other global trade rules. But nationalism is only a billionaire's concern in the limited ways his holdings are affected by international affairs or global trade wars. While Trump's alleged ties to Russians could prove his political downfall, in the world he and his billionaire posse inhabit, national borders are much less important than the relationships between multinational fiefdoms and the banks that back them.

The Trump Organization does deals all over the world, from Dubai to Istanbul to Moscow, but the president's global branding operation is capitalism lite compared with, say, Ross's multinational empire. Before his confirmation hearing, Ross agreed to divest hundreds millions of dollars in assets, including his piece of the Bank of Cyprus, which the Russian mob has reportedly used for money laundering. He is keeping his stake in a transoceanic tanker giant called Diamond S Shipping Group Inc. The Center for Public Integrity looked at that company's operations and found its vessels sail under Chinese flags, and one of its ships has traveled to an Iranian port—which Diamond S has said was legal. Ten percent of its business comes from a Swiss company with stakes in Russian national oil giant Rosneft.

Ross's internationalism is hardly unique. Feinberg's DynCorp has reportedly trained Afghan police and has contracts in Saudi Arabia. Roth is building a New York apartment tower for the über-wealthy, with one of its units reportedly priced at a record $250 million—and the project is financed by nearly a billion dollars in Bank of China loans. It's a good bet that the billionaires will probably see to it that Trump's xenophobia doesn't interfere with business.

If there's one issue that binds almost all New York billionaires—even those who don't support Trump—it's a loathing of federal regulations, especially on the financial industry but also on commercial developments and industry. While not as historically active fighting regulations as, say, the Koch brothers, Icahn can't wait for Trump to deregulate everything. He hailed his friend's inaugural speech as a sign that "our dangerous slide towards socialism is over."

In the chaotic first few months of his presidency, Trump's signature achievement has been rampant deregulation. He has been ripping out, at a record pace, regulations covering everything from the financial industry to pollution to food safety to firearms. His billionaires and their accountants already know how this activity can improve their bottom line. What remains to be seen is whether average Americans will reap any collateral benefits, besides the newly won freedom to drive cars without mileage or emissions standards, take medications for off-label uses, drill for oil in national parks and, if mentally ill, buy a handgun.