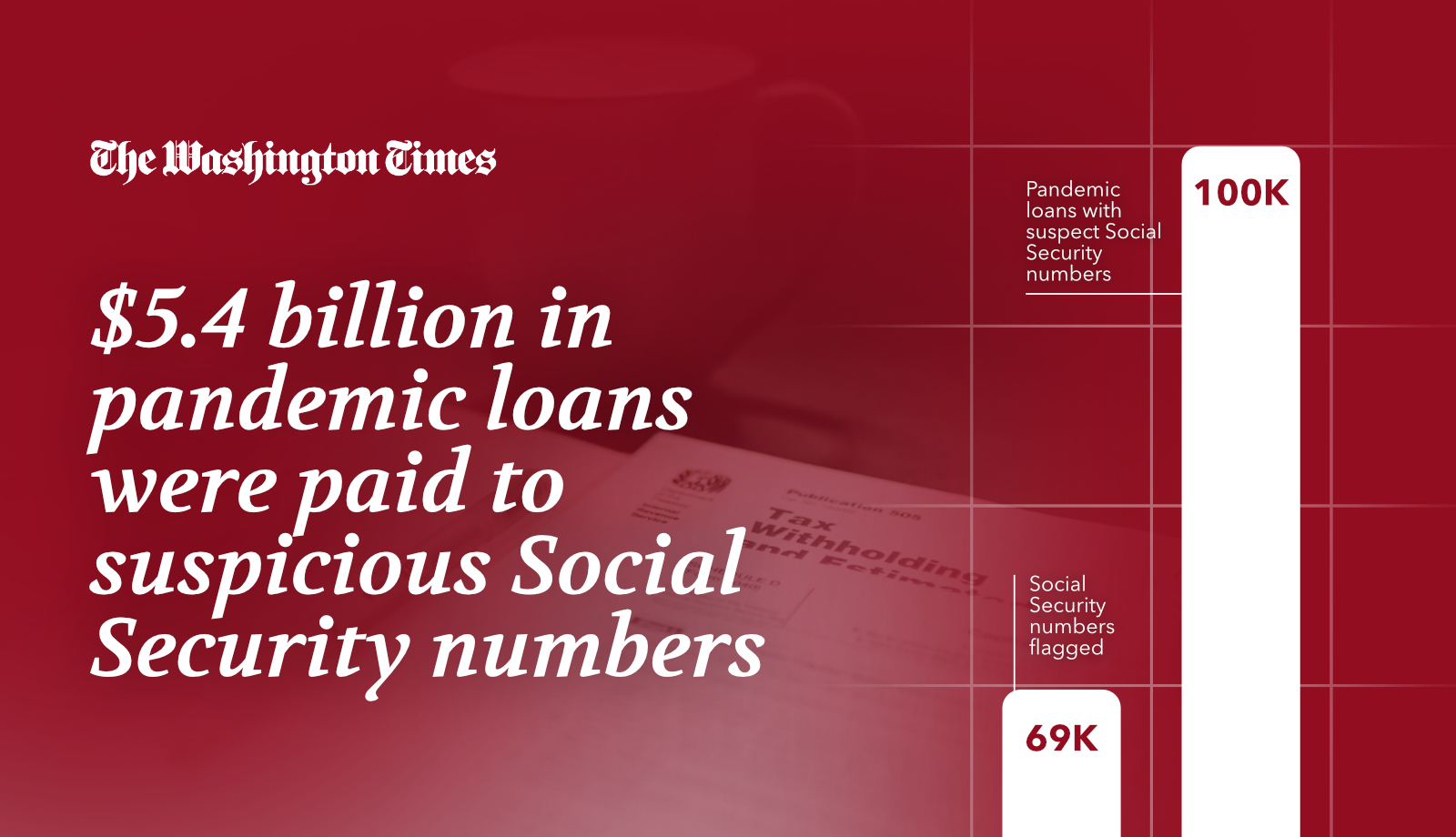

The government doled out nearly 100,000 pandemic loans to people whose applications were filed using suspect Social Security numbers, government investigators revealed Monday.

The suspicious applications were awarded $5.4 billion from the Small Business Administration.

Investigators said the bogus payments appear to have been made early on, when the Trump administration was eager to pump money into the economy and worried less about controls of fraudulent claims. Applicants weren’t even checked against the Treasury Department’s “Do Not Pay” list.

Controls got better as the initial shock of the pandemic wore off. But by then, much of the money was already out the door, according to the Pandemic Response Accountability Council, the consortium of inspectors general that has been tasked with policing the spending.

“The PRAC identified $5.4 billion in potential identity fraud associated with 69,323 questionable and unverified SSNs used across disbursed COVID-19 EIDL and PPP applications — that is, applications that successfully received a loan and/or grant,” the PRAC said in its report.

Through the Economic Injury Disaster Loan program and the Paycheck Protection Program, SBA received more than 33 million applications and doled out nearly $1.2 trillion in loans.

SEE ALSO: Tens of thousands of federal employees bilked government of pandemic cash

PRAC said it analyzed the applications, stacking them up against Social Security numbers.

In most cases the number was valid, but the application didn’t match the person to whom Social Security issued the number. In other instances, the number was totally fabricated.

All told, more than 69,000 numbers were flagged, covering 99,180 total pandemic loans.

Those were just the ones paid out.

Investigators said more than 175,000 other loan applications filed with suspect Social Security numbers were blocked.

SEE ALSO: Drones and water slides: How cities spent Uncle Sam’s pandemic money

That was good news, but investigators said the applications still deserve follow-up because fraudsters could try to use the same identities to scam other government programs.

The White House said the report was a damning indictment of the Trump team’s handling of matters, and an endorsement of the steps the Biden administration took to place new controls on pandemic spending.

Even a simple check against the Do Not Pay list could have blocked billions of dollars in bogus payments.

“The issue of identity theft in PPP and COVID-EIDL programs highlighted by the PRAC report is a prime example of why it was a mistake to not implement additional anti-fraud measures during the Trump administration,” said Christina Carr, a spokesperson at the Small Business Administration.

For more information, visit The Washington Times COVID-19 resource page.

• Stephen Dinan can be reached at sdinan@washingtontimes.com.

Please read our comment policy before commenting.