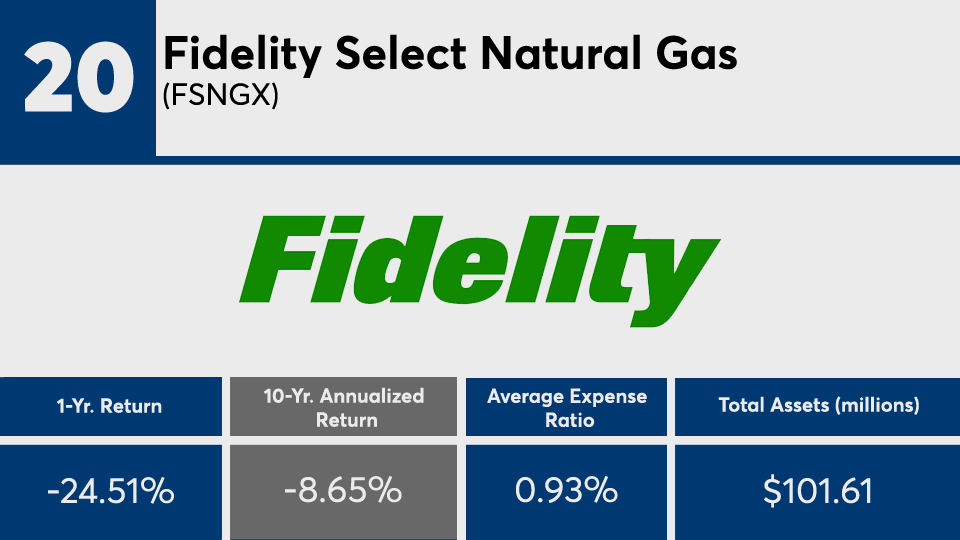

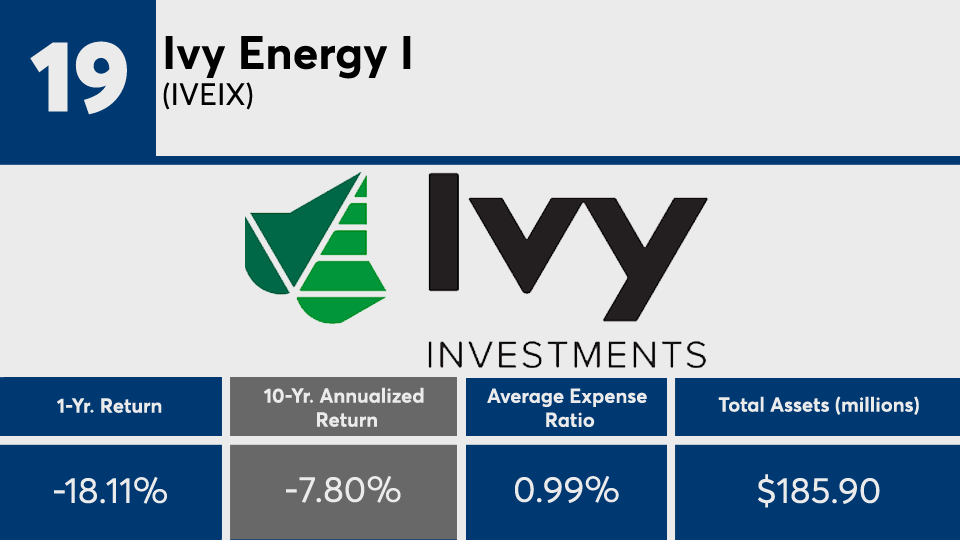

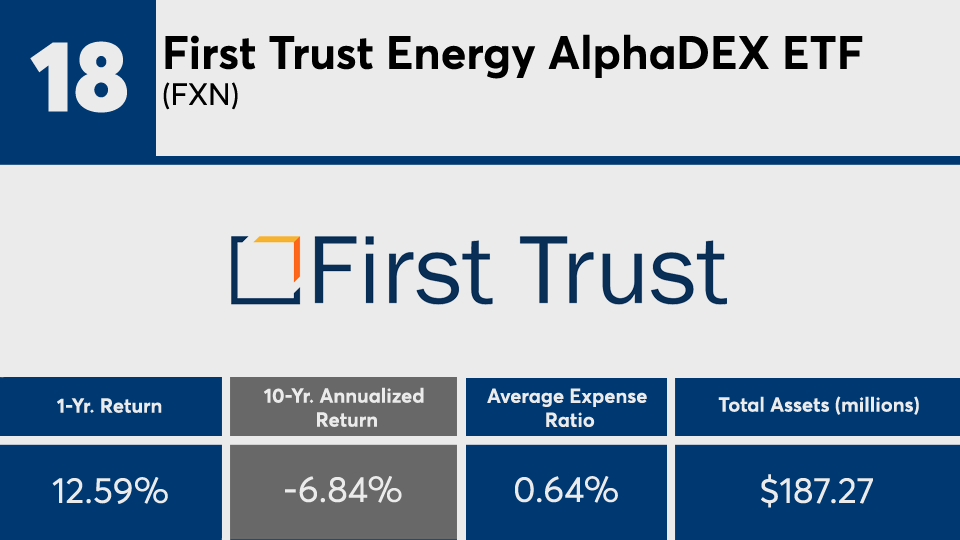

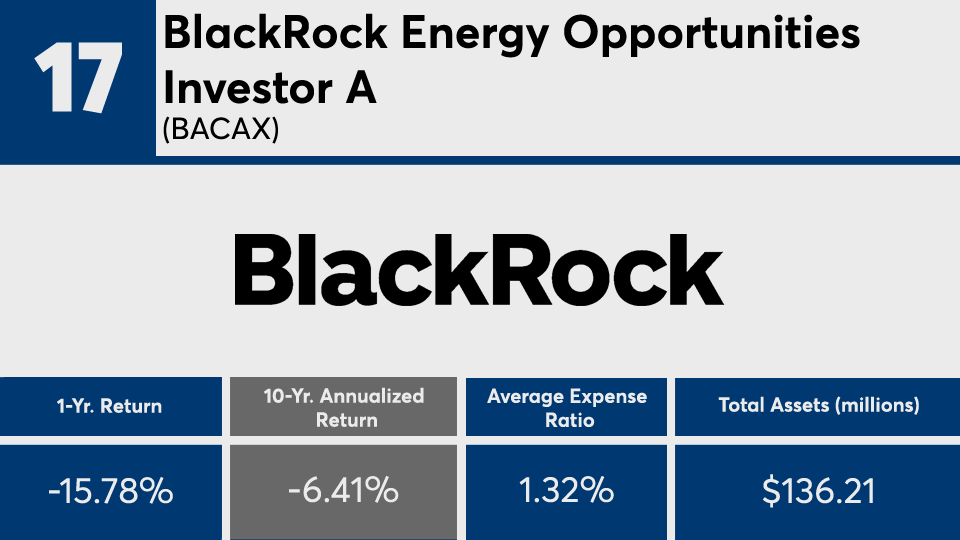

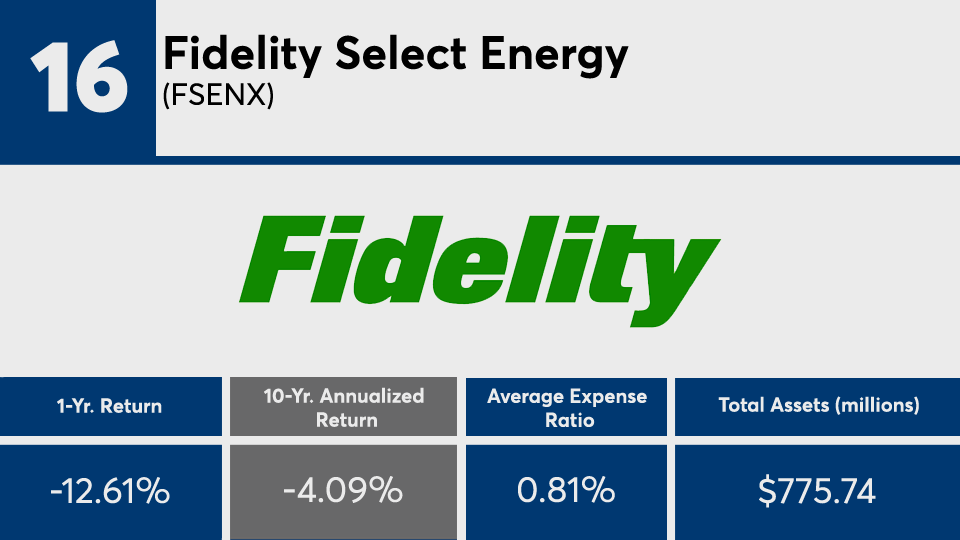

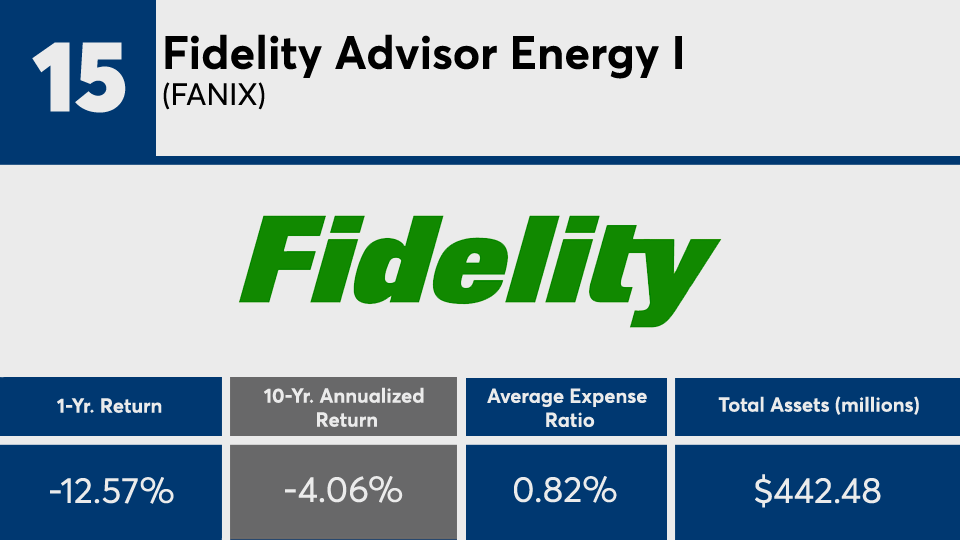

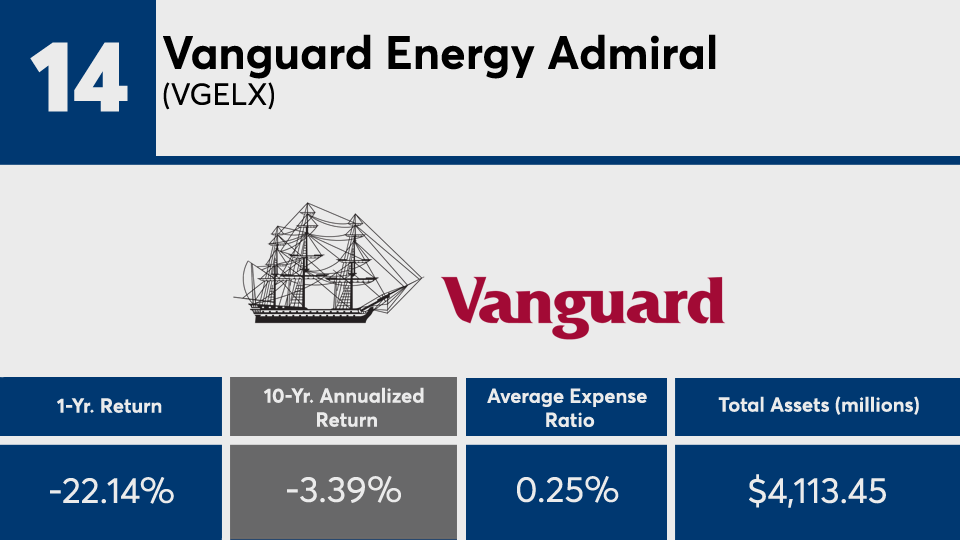

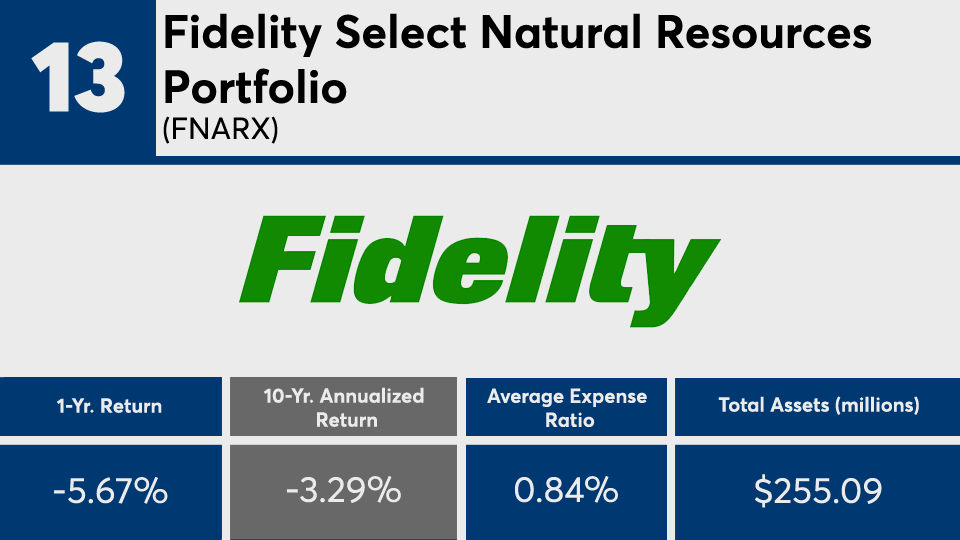

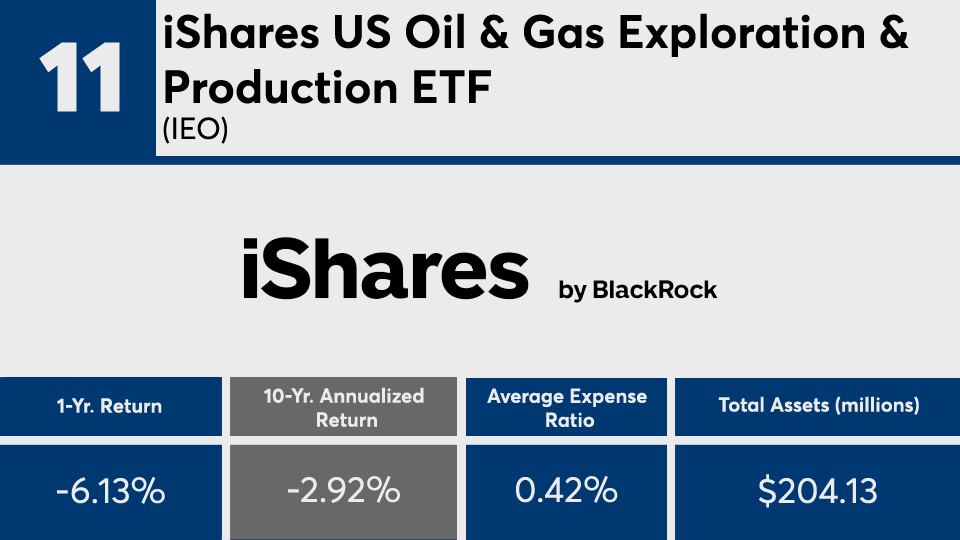

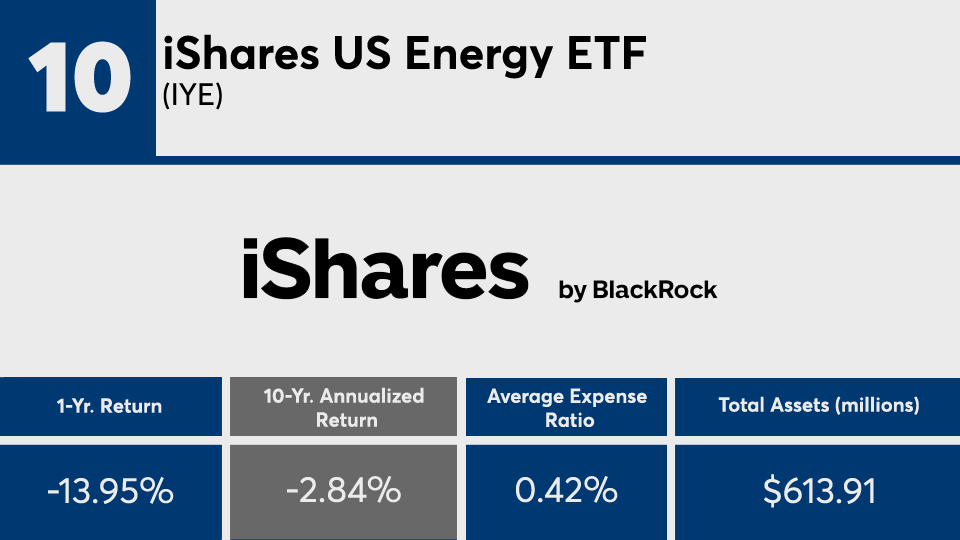

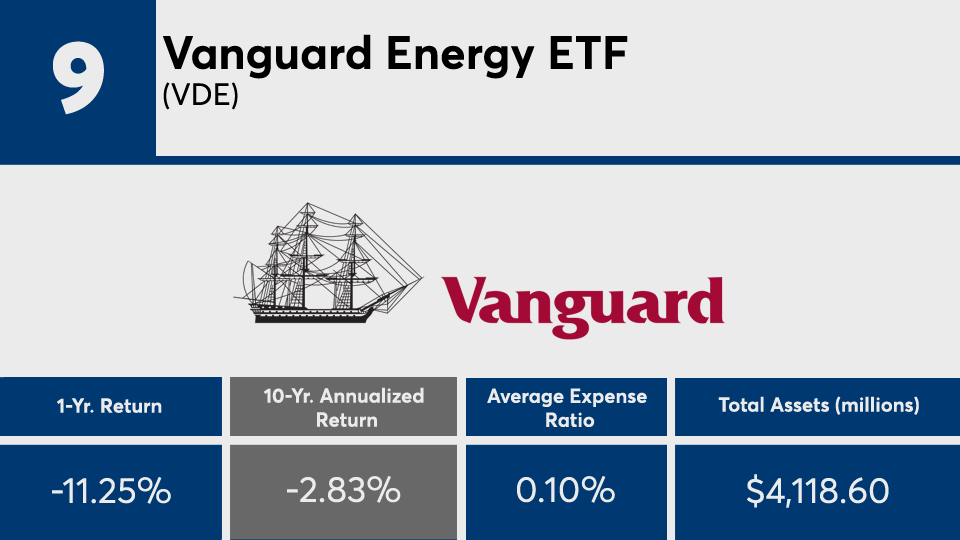

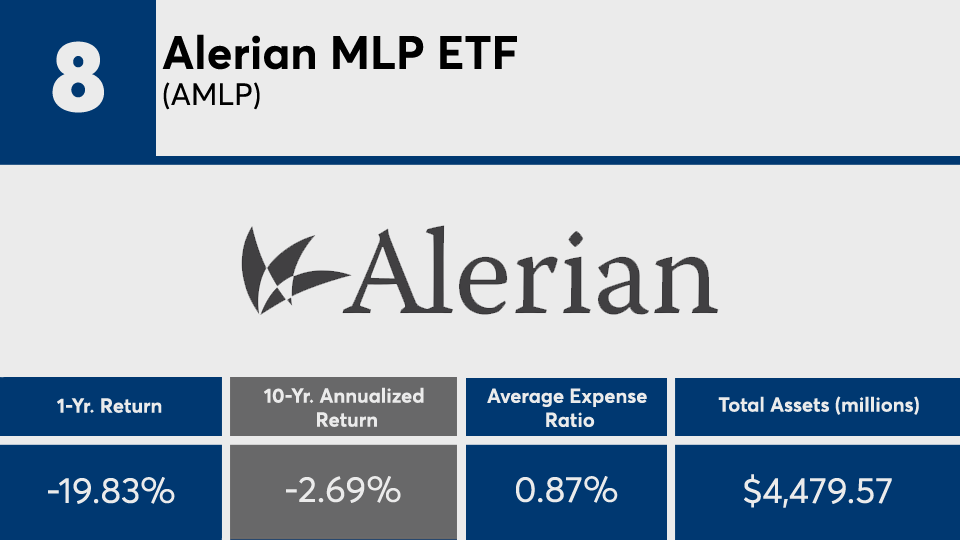

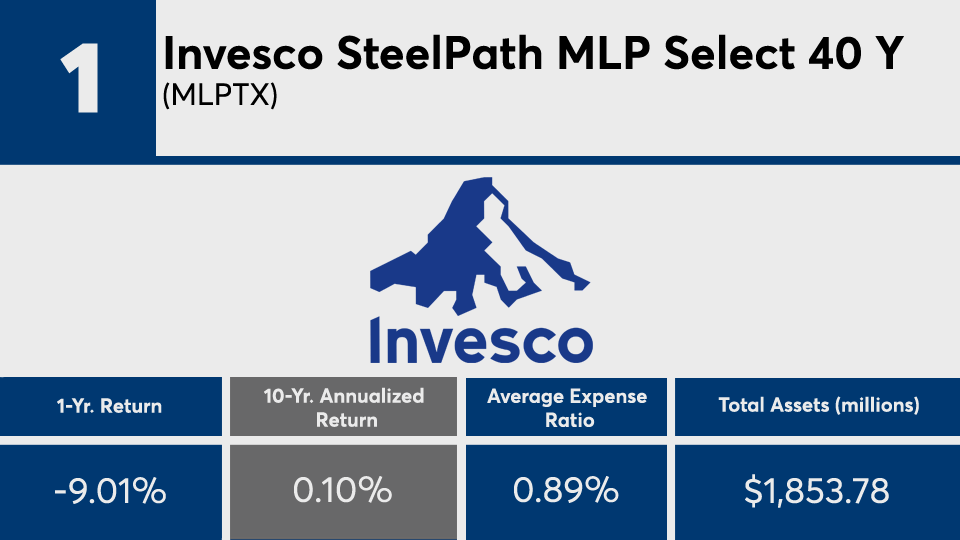

All but one of the decade’s top-performing energy funds have posted losses.

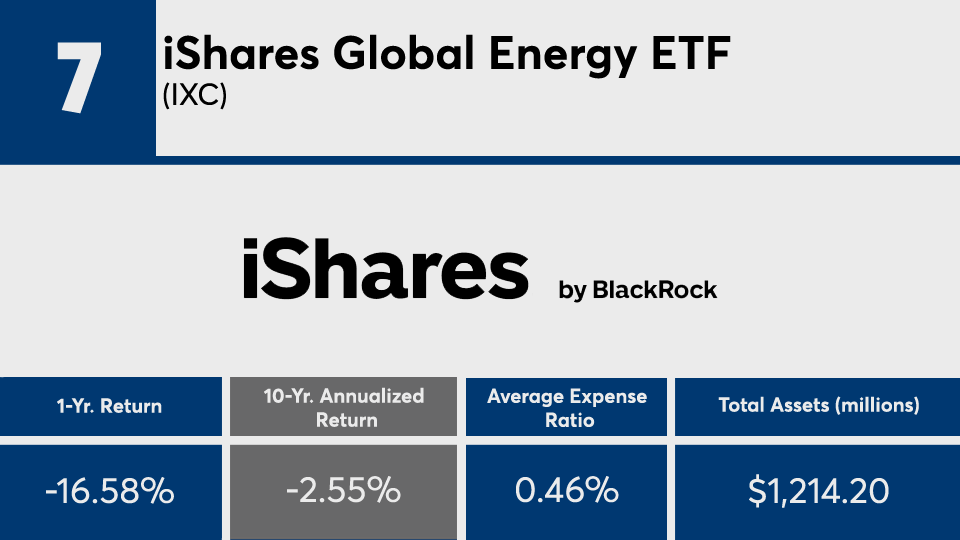

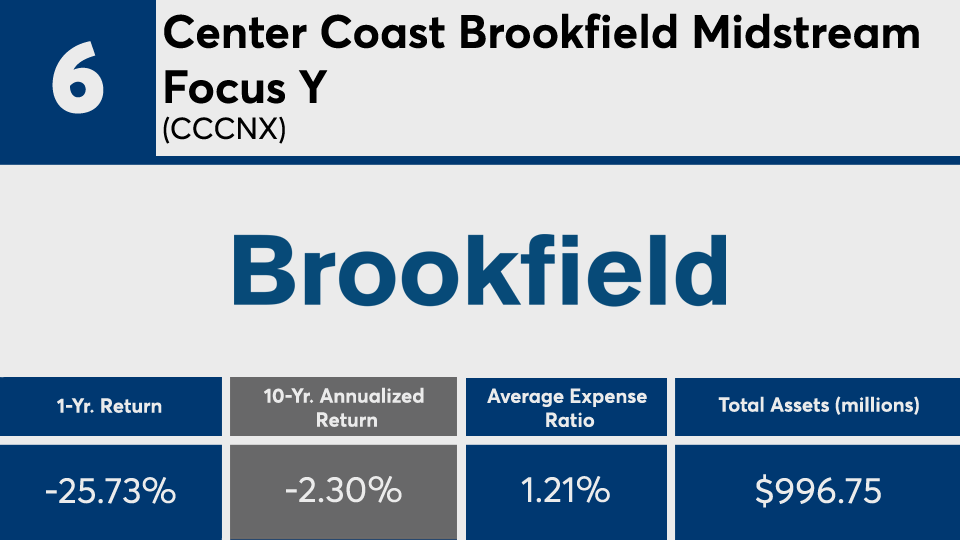

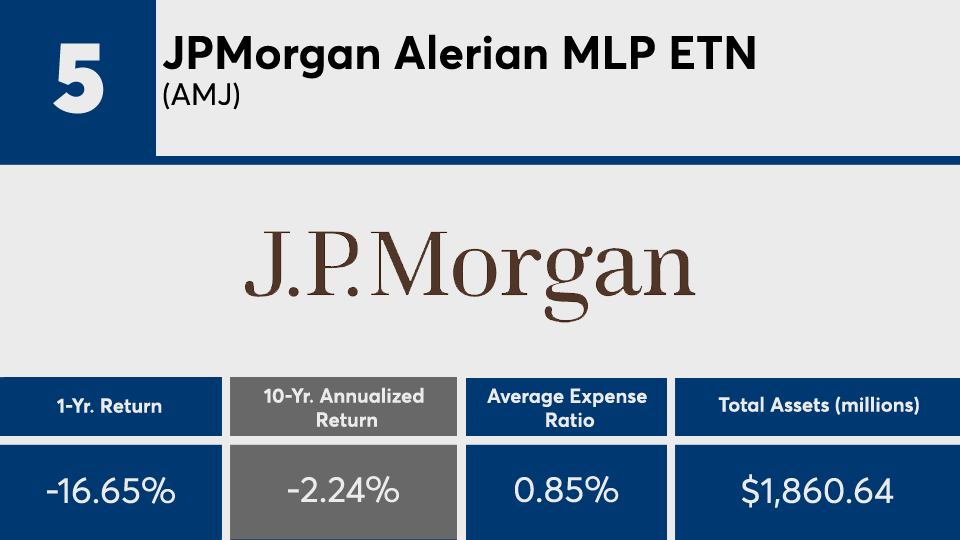

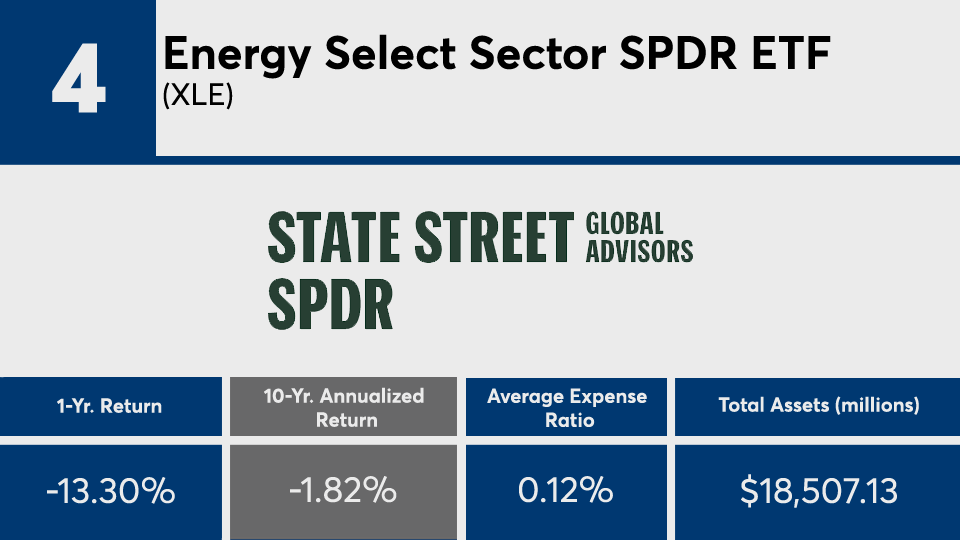

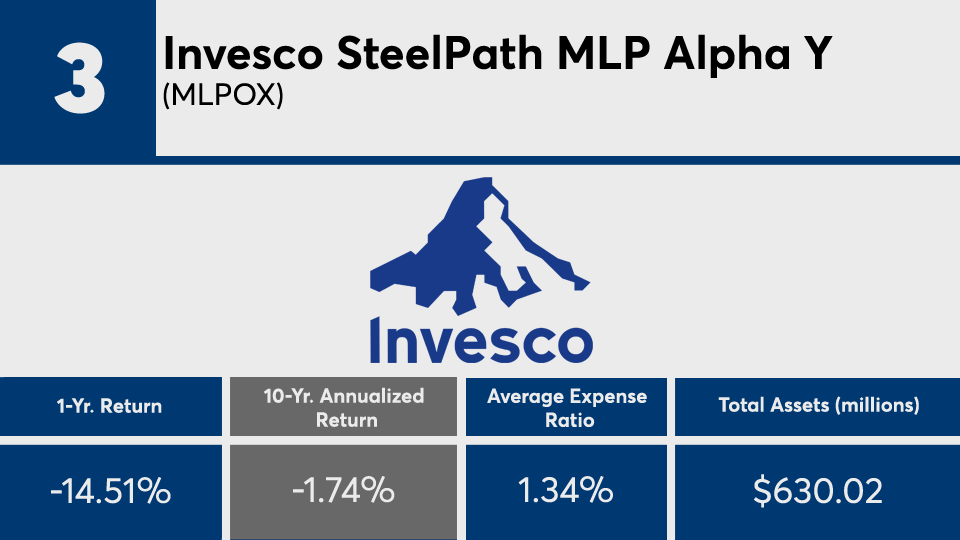

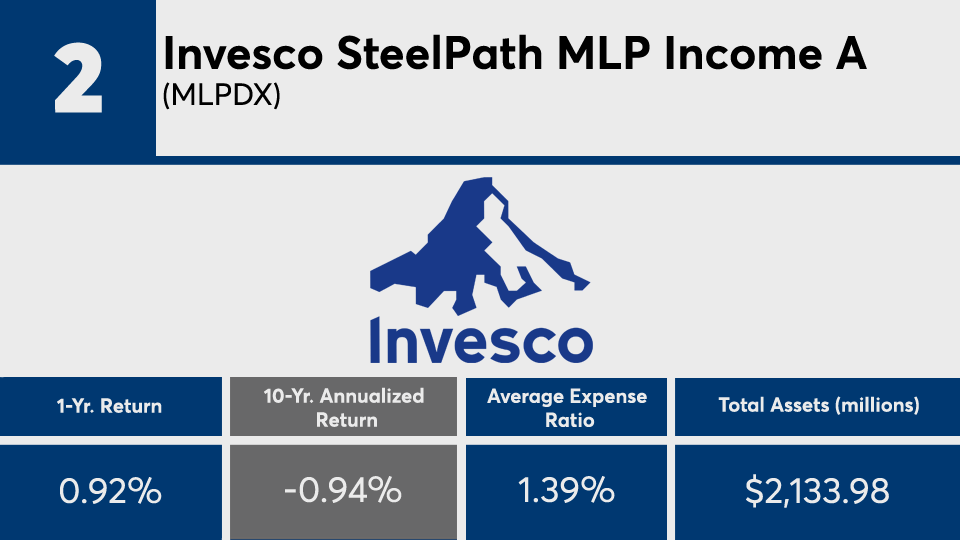

With an overall 10-year loss, it’s safe to say there are no real long-term winners among equity energy and energy-limited partnership category mutual funds and exchange-traded products. The leading 20, with at least $100 million in assets under management, notched an average loss of more than 3.5%, Morningstar Direct data show. The same funds posted a one-year loss of 12.5%.

A look under the hood shows the holdings that make up these sector funds largely track an industry that has failed to transition from fossil fuels to clean and renewable energy, says Peter Krull, founder, CEO and director of investments at Earth Equity Advisors.

“These performance trends are likely to continue as the need to reduce emissions grows greater by the day,” says Krull, adding, “With the Biden administration placing a heavy focus on climate change, investors will be looking to opportunities in a cleaner next economy and eliminating the dinosaurs of fossil fuels and the old economy.”

Compared with the broader fund industry, index trackers such as the SPDR S&P 500 ETF Trust (

In bonds, the iShares Core U.S. Aggregate Bond ETF (

The losses from the funds in this ranking carried a hefty price tag. With an average net expense ratio of more than 80 basis points, energy funds with the best 10-year returns were well above the 0.45% investors paid for fund investing in 2019, according to

Though advisors often deal with long-term investment strategies, that doesn’t necessarily mean they should ignore overarching trends in the short term, Krull says.

“Financial advisors should keep in mind the changing nature of the global economy as they consider adding specific sectors to their client portfolios,” he says.

Scroll through to see the 20 equity energy and equity limited partnership category mutual funds and ETPs, with more than $100 million in AUM, and the biggest 10-year annualized gains. Assets and average expense ratios, as well as one-, three- and five-year returns through Feb. 15 are also listed for each. The data show each fund's primary share class and current portfolio manager or managers. All data is from Morningstar Direct.