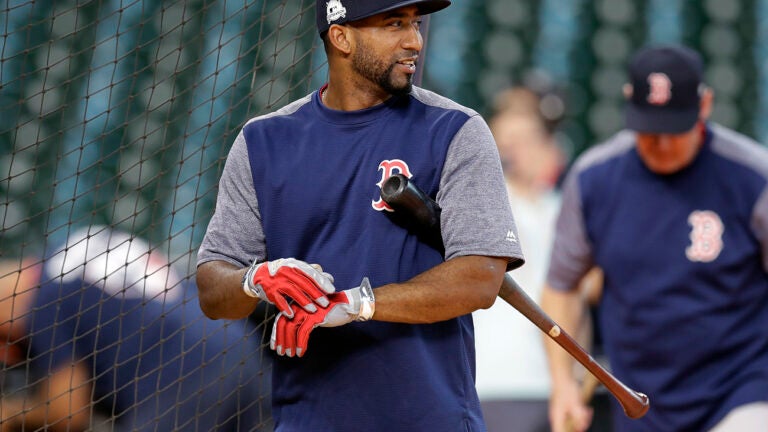

Why the structure of the Eduardo Nunez deal is significant for the Red Sox

FORT MYERS, Fla. – On its surface, the one-year, $4 million deal with a $4 million player option and $2 million buyout for Eduardo Nunez looks straightforward enough. But the structure of the deal represents an act of creative accounting that was intended not just to bring back a player whom the Red Sox wanted but also to do so in a way that minimizes his impact on the team’s payroll as calculated for luxury tax purposes.

Here’s the skinny: Nunez is guaranteed $6 million (the $4 million for 2018 along with the $2 million buyout). Under the Collective Bargaining Agreement, player option years are treated as guaranteed. So, for purposes of calculating the team’s payroll for luxury tax purposes, the Nunez deal is treated as a two-year, $8 million deal with an average annual value of $4 million.

If Nunez opts out of the contract after one year, the Red Sox would get hit with the difference between what they actually paid Nunez ($6 million) and the number that they were charged for luxury tax purposes ($8 million over two years). However, the difference between those figures — $2 million — will be assessed as part of the calculation of the team’s 2019 payroll for luxury tax purposes, rather than its 2018 number.

Why is that significant? As noted in this week’s examination of the Red Sox’ payroll obligations, the Red Sox’ 2018 projected payroll (as calculated for luxury tax purposes) probably sat around $214 million or so prior to the signing of Nunez. The lower a 2018 AAV for Nunez, the more room the team has to spend below the crucial $237 million threshold that sets in motion the biggest penalties for surpassing the luxury tax.

There are three luxury tax tiers this year: One at a $197 million payroll, a second at a $217 million, and a final one at $237 million.

The team has a strong preference to stay below the highest luxury tax threshold of $237 million — both because they will get taxed at a 62.5 percent rate for every dollar spent beyond $237 million, and perhaps more significantly, because their top draft pick would get dropped by 10 spots.

The creative accounting with the Nunez deal, then, permits the Sox to preserve a larger amount of space under the $237 million threshold — money that they can use in their efforts to acquire slugger J.D. Martinez. Right now, even building in a considerable amount of in-season flexibility, the team still has somewhere in the vicinity of $20 million to spend while staying under that figure.

The deal also includes the ability for Nunez to make $2 million in bonuses on his 2019 salary based on his number of plate appearances in 2018 and 2019: $1 million in 2019 salary escalators based on his plate appearances in 2018, and another $1 million in potential bonuses based on Nunez’s 2019 plate appearances. Again, those potential bonuses would count only against the team’s 2019 payroll for luxury tax purposes.