From inflation to higher interest rates, Canadians have faced financial hurdles in the past few years and they may be feeling concerned about their futures and ability to get ahead.

A report released Wednesday from Statistics Canada shows there have been disparities between wealth and debt among Canadian households and among those under 35, some are feeling the pinch between the debt they have and what they can do to achieve stability.

But StatsCan warns that the shift away from homeownership being seen by younger Canadians could pose potential risks to people wanting to improve their financial status and wealth, with ongoing barriers posing risks to socioeconomic mobility.

University of Toronto Rotman School of Management marketing professor David Soberman told Global News homeownership has often been seen as a financial benefit.

“When you actually buy a home, the capital gains on your home are exempt from tax because it’s your primary residence. And so in a sense, there’s a certain unfairness in that because people who are renting don’t get that same advantage,” he said.

“This is one of the reasons that buying a home, even if it’s not actually a standalone house, but a condominium or a townhouse, has always been an important starting point for people to increase their wealth and improve their standard of living.”

- Premier Moe responds to Trudeau’s ‘good luck with that’ comment

- Drumheller hoping to break record for ‘largest gathering of people dressed as dinosaurs’

- As Canada’s tax deadline nears, what happens if you don’t file your return?

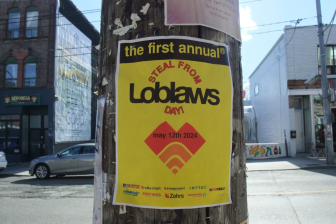

- Posters promoting ‘Steal From Loblaws Day’ are circulating. How did we get here?

According to StatsCan economic analyst Carter McCormack, when looking at barriers to the housing market there’s multiple factors involved in affordability. This can include the cost of the first downpayment, the ability to service the debt, the interest and ability to save.

McCormack noted the report also found net savings for most income groups declined and lower income earners were actually “dissaving” meaning money isn’t actually being put away. Instead, they’re drawing from their existing savings to pay for the increased cost of living, higher grocery prices and other inflationary pressures like rent.

“As affordability pressures continue to evolve, I think young people are going to evolve their preference towards entering the housing market,” McCormack said. “Of course, we’ve seen in the past that if affordability pressures go down, you may be able to increase your mortgage holdings.”

When it comes to social mobility, Soberman notes owning a home is not the only factor. He said one thing that’s contributed to high degrees of social mobility in Canada has been the strength of the education system compared to other countries, allowing people that “have ability to actually move up and become successful.”

When it comes to high levels of social mobility, Soberman said that it can lead to better feelings of happiness.

“People in lower or middle-income brackets feel … like they’re a hamster on a spinning wheel,” he said. That hamster wheel, he notes, often can be found in countries where there’s a huge gap between the rich and poor.

Soberman said the hope is struggles like inflation and high interest rates are temporary. But, he notes, governments will need to take action to get inflation fully under control, and to improve the housing market so Canadians don’t feel like they’re having to pinch pennies to get ahead.

Comments