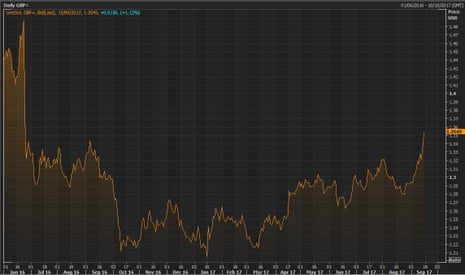

The pound keeps on rising.

It is now up 1.4% at $1.3585, the highest level since 24 June 2016, the day after the EU referendum when the Brexit vote became clear.

The pound hit $1.36, the highest level since 24 June 2016, after Bank of England policymaker Gertjan Vlieghe said interest rates could rise in ‘coming months’

The pound keeps on rising.

It is now up 1.4% at $1.3585, the highest level since 24 June 2016, the day after the EU referendum when the Brexit vote became clear.

The pound is at the highest level since the days immediately following the Brexit vote:

Sterling is also at a two month high against the euro, at €1.1344 (up 0.9% on the day).

The pound’s gain is the FTSE 100 loss. The leading index of UK shares is now down almost 1% or 67 points at 7,227.

Markets elsewhere in Europe are roughly flat, but the FTSE is often dragged lower by a stronger pound because companies included in the index tend to be multinationals with a large proportion of earnings taken in countries outside the UK.

David Madden, analyst at CMC Markets, has this take:

The FTSE 100 is the worst performer in Europe thanks to the strong pound again. The British market started off in the red today because of the more hawkish than expected update from the Bank of England yesterday, and the speech from Gertjan Vlieghe, a short time ago, accelerated the move. Mr Vlieghe also hinted at a tighter monetary policy, which pushed the pound higher, and drove the FTSE 100 lower.

The FTSE 100 has dropped to its lowest level in over four months, and it is also trading below its 200-day moving average – which is widely viewed as bearish.

The pound has surged 1.1% against the dollar at $1.3543. It is the first time above $1.35 since 27 June 2016, days after the Brexit vote.

Those comments from the Bank of England’s MPC member, Gertjan Vlieghe, have convinced traders that the first UK rate rise since June 2007 is coming in November.

The MPC had already signalled on Thursday (alongside its policy decision) that it was nearing the time to raise rates, and Vlieghe’s speech has added weight to that.

MPC members tend to use speeches as opportunities to clarify the committee’s latest thinking, and signal any shift in policy stance.

Here are Vlieghe’s key quotes:

Until recently, I thought the appropriate response of monetary policy was to be patient, given modest growth and subdued underlying inflationary pressure. But the evolution of the data is increasingly suggesting that we are approaching the moment when bank rate may need to rise.

He said a rise could come “as early as in the coming months”. Rates are currently at an all-time low of 0.25%.

Here is our full story on the speech:

Gertjan Vlieghe, an external member of the Bank’s monetary policy committee, has given the strongest signal yet that interest rates could rise as soon as November.

Having voted to hold rates at 0.25% at the August meeting on Thursday, Vlieghe said in a speech in London that rates could rise “as early as in the coming months”.

The pound is up 0.8% above $1.35.

More soon.

Tim Martin, the founder and chairman of JD Wetherspoon says companies in the EU will suffer more from Brexit than the pub group will.

Martin was a vocal supporter of Brexit, and in his latest comments on the subject alongside Wetherspoon’s annual results, he said EU leaders need to take a “wise-up pill” to grasp the reality of the situation.

Most plcs are expected to comment, in their results statements, on the UK’s prospects outside of the EU and on the likely impact on their individual companies. It is my view that the main risk from the current Brexit negotiations is not to Wetherspoon, but to our excellent EU suppliers – and to EU economies.

It is my view that Juncker, Barnier, Selmayr, Verhofstadt and others need to take a wise-up pill in order to avoid causing further economic damage to struggling economies like Greece, Portugal, Spain and Italy - where youth unemployment, in particular, is at epidemic levels.

Wetherspoon also cautioned that the strong start to its new financial year could not be sustained.

Read our full story on Martin’s comments and on the results here:

European markets are down this morning as another missile launch by North Korea unnerved investors.

Having said that, the scale of the losses are modest, suggesting a muted response as markets become more accustomed to escalating events in Pyongyang.

Alan Clarke, economist at Scotiabank, has changed his forecast for the timing of the first UK rate rise, following the Bank of England’s hints on Thursday.

He now expects the Bank’s MPC to raise rates to 0.5% (from 0.25%) in November, to coincide with the next quarterly inflation report. Previously he was expecting the first hike to come in mid-2018.

Clarke says that a rise of 0.25 points would not necessarily be the first of many. Rather, it would unwind the 0.25 point cut from August last year, when the MPC was fearful the Brexit vote would deliver an immediate shock to the economy.

We doubt it would be the first of several hikes. Our judgement is that the MPC will use the current backdrop as an opportunity to take back last August’s emergency rate hike now that there is no longer an emergency.

We have our doubts that the data will stay sufficiently robust to provoke another hike at the subsequent inflation report meeting in February. Rather, we suspect the committee will await the crucial start of year wage inflation numbers before delivering a second hike at the May-2018 meeting.

The pound is currently up 0.3% against the dollar at $1.3442. That is the highest since 7 September 2016.

Against the euro, the pound is up 0.2% at €1.1262 - the highest since July.

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

The pound has held on above $1.34 this morning, its highest level in more than a year, after the Bank of England hinted on Thursday that a rise in interest rates might be coming sooner than people think.

The hints - which came as the Bank’s Monetary Policy Committee held rates at all-time low of 0.25% - prompted some investors and economists to predict a rate rise as soon as November.

It would be the first rise in interest rates since July 2007, when the world was blissfully unaware of the massive financial crisis ahead.

Also coming up today:

Comments (…)

Sign in or create your Guardian account to join the discussion