Anyone know why 'motion picture, video and TV programming' saved the day for GDP? Are we filming more post-Brexit...? pic.twitter.com/QQSKEkr3xc

— Tom Knowles (@tkbeynon) October 27, 2016

UK economy up 0.5% since Brexit vote, Nissan to build new Qashqai in Sunderland – as it happened

Britain’s economic growth has beaten expectations, as Japanese carmaker pledges new investment for its Sunderland plant

Earlier:

Thu 27 Oct 2016 10.03 EDT

First published on Thu 27 Oct 2016 02.42 EDT- Closing summary: UK defies Brexit fears, for now...

- UK car industry wants Brexit assurances

- Breakthrough in EU-Canada trade deal deadlock

- Theresa May hails Nissan's Qashqai decision

- Nissan: We're sticking with Sunderland following May's Brexit pledge

- Reuters: Nissan to build next Qashqai in Sunderland

- GDP: Some more detail

- TUC: No room for complacency

- Economists: Brexit vote impact will be felt in 2017

- Hammond hails GDP report

- ONS: Little evidence of Brexit effect

- Service sector grows, everything else shrank

- UK GDP RELEASED

- Lagarde: Brexit uncertainty is damaging

- Introduction: WELCOME TO GDP DAY

Live feed

- Closing summary: UK defies Brexit fears, for now...

- UK car industry wants Brexit assurances

- Breakthrough in EU-Canada trade deal deadlock

- Theresa May hails Nissan's Qashqai decision

- Nissan: We're sticking with Sunderland following May's Brexit pledge

- Reuters: Nissan to build next Qashqai in Sunderland

- GDP: Some more detail

- TUC: No room for complacency

- Economists: Brexit vote impact will be felt in 2017

- Hammond hails GDP report

- ONS: Little evidence of Brexit effect

- Service sector grows, everything else shrank

- UK GDP RELEASED

- Lagarde: Brexit uncertainty is damaging

- Introduction: WELCOME TO GDP DAY

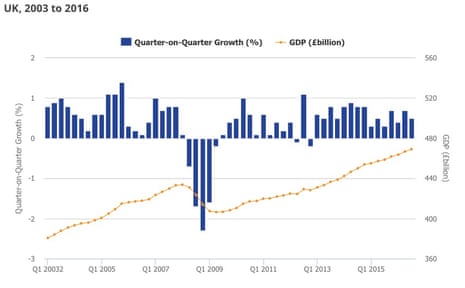

GDP: Some more detail

I’ve quickly truffled through today’s GDP report to get some colour on how the UK economy performed

1) Services: The only sector to grow, by a punchy 0.8%. All four sub-sectors expanded (that’s distribution, hotels and restaurants; transport, storage and communication; business services and finance; and government and other services).

Growth was particularly strong in the “motion picture, video and TV programme production, sound recording and music publishing activities, and computer programming industries”, apparent.y

2) Industrial production: It suffered a 0.4% contraction. That’s mainly because manufacturing output shrank by a whole 1%. Energy supply fell by 3.6%, water and waste management dropped by 0.2%, while mining and quarrying increased by 5.2%

3) Construction: Output fell by 1.4%, which is the biggest decline since 2012. That’s partly because construction of new housing fell, for the first time in a year.

4) Agriculture:

Philip Hammond has also told the BBC that the UK economy is looking strong, as the EU exit talks loom:

Chancellor @PHammondMP tells @andyverity that GDP figures show UK economy in a position of strength ahead of EU negotiations pic.twitter.com/YPHH3nBtBI

— Mark Broad (@markabroad) October 27, 2016

TUC: No room for complacency

TUC general secretary Frances O’Grady says the government needs to do more to help UK manufacturing (which contracted by 1% after the Brexit vote):

“We can’t yet say what impact Brexit will have on our economy, but these figures show there’s no room for complacency. British manufacturing is still struggling, and now faces real uncertainty following the vote to leave the EU.

“The government must use next month’s Autumn Statement to boost Britain’s jobs and wages. This means investing in infrastructure like roads, rail and homes, and raising the national minimum wage.”

Economists: Brexit vote impact will be felt in 2017

Today’s GDP report is an important measure of the health of Britain’s economy after June’s historic referendum.

But several economists say the real test of the Brexit vote will come in 2017, not today.

Here’s PwC’s Andrew Sentance:

UK #GDP was resilient in Q3, led by services. But impact of #Brexit decision on investment still likely to dampen growth next year.

— Andrew Sentance (@asentance) October 27, 2016

Geoffrey Yu, head of UK Investment Office at UBS Wealth Management, predicts that growth will keep slowing:

Anecdotal evidence supports the view that we’re yet to see any meaningful damage as a result of the Brexit vote, at least in the short-term.

“Of course, we should not overlook the lingering sense of uncertainty. Though the economy has fared better than initially feared, we expect that economic growth will slow down relative to the early part of this year.

Jeremy Cook, chief economist at the international payments company World First, says we’ll have a better picture once Theresa May has triggered article 50:

“We have called the UK consumer a hardy beast in the past and in Q3 the beast was back. The services sector singlehandedly drove growth to a 15th consecutive positive quarter and while the ‘little evidence of a pronounced effect’ from the Brexit vote is being seen yet, we think that it will be as gradually obvious as the year comes to an end. The beast will tire as inflation fires arrows at its increasingly weakening hide.”

Thomas Laskey of Aberdeen Asset Management argues that the Bank of England should get some credit for today’s growth report:

“The data shows that the UK economy fared well in the aftermath of the EU referendum. It confirms what most investors thought: that sentiment bounced back after the initial shock of the result. Growth was fairly strong, at least in part because the Bank of England restarted its bond buying programme and the fact that changes to investment plans take time to play out.

But he predicts slower growth next year:

“The outlooks for growth is pretty uncertain. Brexit has the potential to be extremely costly to the UK and the country could be poorer as a result. We’ve already seen this reflected in sterling’s dramatic drop. Growth will probably slow as import costs increase and people’s incomes fall as inflation rises. We are not out of the woods yet by any means.”

You can see the GDP report online, here:

Gross Domestic Product, preliminary estimate: July to Sept 2016

Hammond hails GDP report

Chancellor Philip Hammond says today’s report shows that the UK economy is resilient, and ‘well-placed’ to deal with the challenges and opportunities created by the EU referendum.

We are moving into a period of negotiations with the EU and we are determined to get the very best deal for households and businesses. The economy will need to adjust to a new relationship with the EU, but we are well-placed to deal with the challenges and take advantage of opportunities ahead.”

Here's my response to today's @ONS GDP figures. pic.twitter.com/GGdt0UCFkr

— Philip Hammond (@PHammondMP) October 27, 2016

Anyone remember George Osborne’s plan to rebalance the economy and create a March of the Makers?

Five year’s later, Britain is as dependent on service sector growth as ever:

So much for rebalancing. UK Q3 GDP growth entirely driven by services sector. Everything else (manufacturing, construction etc) shrinking pic.twitter.com/Cnr1D2Rrj6

— Ed Conway (@EdConwaySky) October 27, 2016

Britain’s economy has now grown for 15 quarters in a row, and is 8.2% higher than the pre-economic downturn peak in early 2008.

Comments (…)

Sign in or create your Guardian account to join the discussion