The typical American family hasn't just taken a hit from the Great Recession. It has taken a beating.

According to new research from the Russell Sage Foundation, the typical American household saw its wealth cut nearly in half as a result of the Great Recession. Prior to the recession, median household wealth had been gradually rising. Over five years from 2003 to 2007, median household wealth adjusted for inflation rose 12 percent. But from 2007 to 2013, median household wealth, adjusted for inflation, decreased 43 percent, from $98,872 to $56,335.

While such a rapid evaporation of wealth is alarming, the explanation is straightforward. For most working people, their most valuable asset is their home. When home prices collapsed, that pulled household wealth down sharply. High unemployment took a toll too, as idled workers drew on savings and retirement accounts to get by. The strong stock market in recent years has done little to help the typical American family, as relatively few households own stock and those accounts tend to be small.

Worse still, the decline in household wealth may not be over. "Through at least 2013, there are very few signs of significant recovery from the losses in wealth experienced by American families during the Great Recession," the authors of the report concluded. "Declines in net worth from 2007 to 2009 were large, and the declines continued through 2013."

The gaping hole in household wealth has lots of implications throughout the economy. For one thing, millions of people have been trying to save a bit more to make up for their losses. That makes sense on an individual basis, but for the whole economy it puts a heavy weight on any recovery. The widespread increase in savings has held growth in check, so that what might have been a quick economic rebound turned into a lingering funk.

Another implication is that lots of people facing retirement have considerably fewer resources to count on than before. Many who are past retirement age are still working, which means fewer job opportunities for young people.

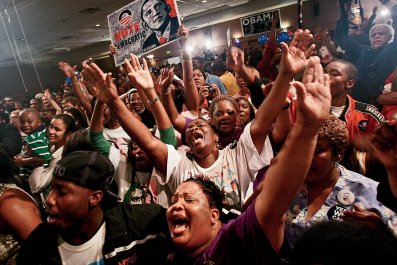

So the next time somebody says the economy is doing well, it's worth reminding that person we still have a long way to go. When median household wealth gets back to where it was in 2007, perhaps then we'll have cause to celebrate.