Last week, billionaire New York hedge fund manager John Paulson invited hundreds of financiers to swap the bitter chill engulfing Wall Street for the sunny beaches of Puerto Rico for the weekend, if not for good.

At an investment conference held a short walk from the soft sands of Condado, east of old San Juan, Paulson, most famous for making a $4bn killing on the collapse of the sub-prime mortgage market, pitched Puerto Rico as a new tax haven with “the potential to become the Singapore of the Caribbean”.

Paulson, who is spending more than $1bn on luxury hotels and resorts on the island, encouraged his fellow financiers to help him turn around the island by moving there and, in doing so, saving themselves a small fortune in tax.

Some of the locals were less than pleased about the sight of some of the world’s richest people lounging on Puerto Rico’s idyllic beaches plotting how to get even richer by exploiting the island’s $72bn debt crisis – a crisis that has pushed millions into poverty and brought the island’s schools and hospitals to breaking point.

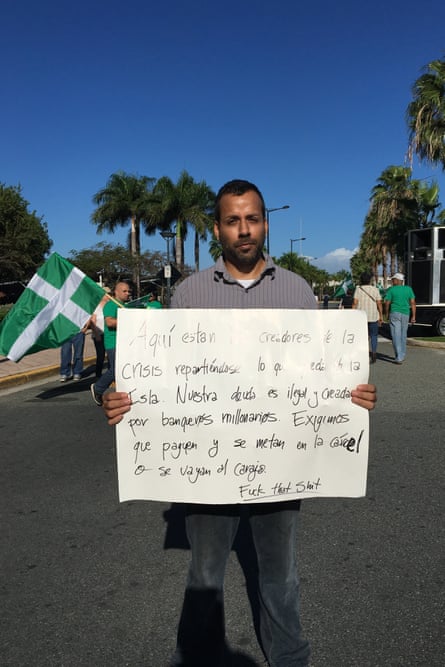

“Puerto Rico residents are not subject to US federal income tax and Puerto Rico, in order to incentivise, has also waived most Puerto Rican income tax so by moving here you can essential minimise your taxes in a way that you can’t do anywhere else in the world,” he said. Outside protesters and politicians marched holding placards accusing the investors of being criminals and destroying their country.

Explaining why he is investing so much money in the island, Paulson said: “Puerto Rico is America. I love the Caribbean and other parts of South America, but what makes Puerto Rico unique is that you get the climate of being so far south [and] you get all the legal protections of the United States.”

And there is much that investors will recognise in the troubled island. There is little sign of economic crisis in the island’s luxury resorts of Bahia Beach, Dorado Beach and San Juan’s exclusive waterfront West Condado neighbourhood with its Gucci and Cartier stores.

‘Unparalleled incentives … to boost your profits’

At the conference, hedge fund managers, who have been accused of helping push the island deeper into crisis by buying up its debts and demanding repayment ahead of spending on schools, were wooed by Puerto Rico’s governor, Alejandro García Padilla.

“This is truly a historic moment full of opportunities,” Padilla told delegates at the Puerto Rico Investment Summit in the island’s convention centre. “We are truly convinced of our unparalleled incentives … to boost your profits.”

More than 1,000 people, including private equity tycoons Nicholas Prouty and Michael Tennenbaum, have already taken advantage of the island’s “aggressive tax incentive” laws 20 and 22 that allow Americans to pay zero tax on US income if they spend at least 183 nights on the island. They also get to keep their US citizenship and passports, which they would have to surrender if they moved to other tax havens like Singapore.

“Acts 20 and 22 are possible only through our unique relationship with the United States,” Padilla said. “No one should be taxed on passive income from doing business in the United States and only Puerto Rico can offer you that.”

Paying zero tax is possible because Puerto Rico is a territory of the United States, not a full state. As such the island’s 3.6 million inhabitants – 45% of whom are below the poverty line – are not able to vote in the 2016 presidential race or any US federal election. The median household income in Puerto Rico is $19,630 – half that of Mississippi, the poorest state in the union, according to the 2014 American Community Survey. Even before the influx of investors exploiting the 20/22 laws, Puerto Rico has a higher rate of income inequality than all the states, according to the World Bank’s Gini index.

‘They should be investing in the community and pay taxes’

Some of the poorest Puerto Ricans live within sight of the convention center across Bahía de San Juan in a waterfront neighbourhood called Vietnam – so named because many of the local people are veterans of that war and described conditions here as “worse than Vietnam”. But they won’t be there for long. Their homes are being bulldozed to make way for a hotel and casino.

Among those given eminent domain orders to leave their homes are Marilyn Rolori and Clarisa Moreno, who volunteers at an after-school club for troubled children. The club, which operates out of the ground floor of a neighbour’s home, is also slated for demolition. “We have lived in our homes for generations, but they are going to be destroyed to make way for rich people coming to our island,” Moreno said. “It is very sad that we will have to make way for these people that are not going to pay any taxes. I would welcome anyone to our country but they should be investing in the community they are joining and pay taxes. It’s not fair.”

Padilla has won over multimillionaires JR and Loren Ridinger of internet marketing firms Market America and Shop.com, who said they are moving their companies to the island. “The big win is that you can accept all orders from across the world in Puerto Rico,” JR Ridinger said. “The amazing thing is you don’t have to declare a dividend, you wait until you have residency and then you can clear it [without paying tax].”

The couple, who spent $5m on their daughter Amber’s wedding at the island’s Ritz Carlton’s Reserve hotel, said residency was a “jigsaw puzzle” and it was hard to schedule enough nights in Puerto Rico “but you know the rules, you sit down and you make it work”.

Another investor won over by Paulson and Padilla is Jason Bennick, founder of software company DMX, who said: “It’s a no-brainer, I am definitely coming.

“You’d have to be foolish and uninformed not to realise how big these tax benefits are,” he said as he browsed stalls advertising gated communities, firearms for personal security and concierge firms. “I am going round collecting these up,” Bennick said of the promotional material for resorts. “If you’re going to have to spend 183 days of the year here, you’ve got to have a cool place to live, you know.”

Bennick, who is spending this weekend checking out Dorado Beach and Paulson’s Bahia Beach resort, said he is a little concerned that the island might not have all the amenities and entertainment he is used to at his homes in Tampa, Florida, and Chelsea, in Manhattan, “but it’s OK for me. I’m divorced, I am focused 24/7 on my business.”

“I don’t drink, I don’t party, I don’t smoke,” Bennick said. “I do my business only, so it will be OK and think how much I will be saving in tax.” He is, however, concerned about the island’s shopping opportunities. “At home, there’s a Whole Foods on every corner, there’s no Whole Foods here. It’s all local and independent shops.”

Fear not: an army of luxury concierge firms, including London’s Quintessentially, have sprung up to help people like Bennick find acceptable grocery stores as well as doctors, dentists and deckhands for their luxury yachts.

Paulette Prats, the head of Quintessentially Puerto Rico, said the firm had set up shop on the island in the last few months because of huge demand from clients moving here to take advantage of the 20/22 laws. “We help them find homes, get them a tax expert, a lawyer, help them find schools for their children and organise weekend breaks on St Barts or St Thomas,” she said.

Helping investors find a home in Puerto Rico can be more of an adventure than it is is Manhattan, Prats said: “20/22 people don’t want to drive, instead we do helicopter tours to the main resorts.”

Mara Montilla, who used to work for Puerto Rico’s government, was also at the conference to network with potential clients for her new venture Elite Arrivals which promises to solve any possible problem for those relocating to the island. “My job is to convince people that it is the right decision to move to Puerto Rico,” she said. “We do everything to smooth the transition, we can find you somewhere to live, find doctors, schools, open doors for business and for you socially.”

Montilla said almost all of her clients love living in Puerto Rico, but she said it can sometime be difficult to convince the spouses of the investor who made the decision to move to the island to save tax. “The wives sometimes have a lot of concerns,” Montilla said. “They ask ‘what am I going to do, what social life will I have?’ I tell them that we have very active social circles here. The key is to meet new people. It is the same as moving anywhere.”

Another concierge, who declined to provide their name, said many clients treat living on the island as a chore they have to endure in order to save money on tax. “They just want to make more money,” the person said. “They don’t want to be in Puerto Rico, they don’t care for Puerto Rico, they don’t interact with the local people. They are just coming here to buy up our land, and pay no tax. It’s really bad, it is horrible.

“The wives fall into depression. Their husbands have said ‘you are going to love it there you can go to the beach every day, there’s a mall, it will be just like the one at home’,” the person said. “You can tell the husband is saying ‘you have to wait honey, we need to make the money’.”

Protesters outside the convention centre said they blamed outside investors for the country’s precarious debts and they don’t think it’s fair to invite rich people to the country and pay no tax when local people have to pay taxes while enduring declining public services in order to try to repay the island’s debt.

“This conference is to help the rich people get richer, it will not help the people of Puerto Rico,” Adrián González Costa of the Puerto Rico Independence Party said. “It is very unfair, they offer overseas people far more benefits than anyone in Puerto Rico. It is like being back in the 19th century again. Then white Europeans were exploiting our land for sugar and tobacco now it is for hotels and Walmart.”