President Obama has cultivated a reputation for approaching politics with a kind of medical clinicism. He is philosophical rather than action-oriented; cold, not bold. It is a reputation that dogged him even in his earliest days on the campaign trail, back when he was running far behind his future secretary of state in the Democratic Primary.

But with the full panorama of his presidency coming into view, Obama’s economic legacy is impressive, even historic. To extend the medical metaphor, Obama has played the part of stoic surgeon in the E.R. His demeanor is rarely anything but placid. But with the operations drawing to a close, the body politic, once in critical condition, has dramatically improved thanks to several targeted interventions.

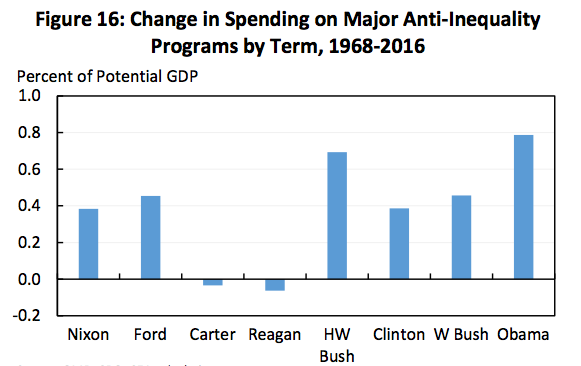

A new examination from the Council of Economic Advisers credits the Obama presidency for the most aggressive and successful attempt to reduce inequality in half a century. “President Obama has overseen the largest increase in federal investment to reduce inequality since the Great Society,” the economists write.

One might immediately think to dismiss such a report as shameless self-promotion from the White House. But the nonpartisan Congressional Budget Office (CBO) reached the exact same conclusion in June. It found that the federal government is doing more to reduce inequality right now than any time on record, going back at least 35 years. The gap between the rich and poor is as wide as ever judging by before-tax income (e.g., wages and capital gains). But judging by after-tax income, the CBO found that income inequality is no higher than it was in 2000, and Obama’s policies have done more to reduce inequality in the last few years than any other time on record.*

In other words, Obama’s economic policies have fought the stubborn forces of economic inequality to something of standstill. How has he done it? President Obama’s anti-inequality crusade has three main pillars.

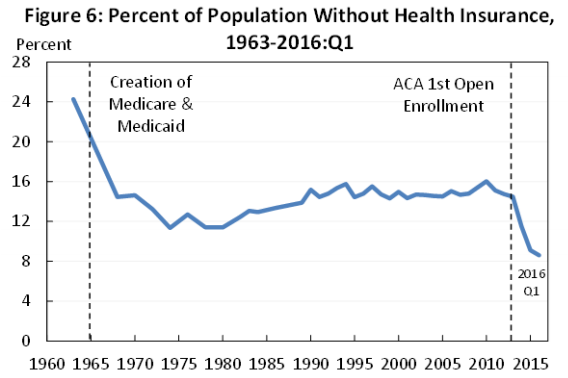

First, the centerpiece of Obama’s anti-inequality legacy is the policy that bears his name. Obamacare, a.k.a., the Affordable Care Act, has reduced the uninsured rate from about 16 percent in 2010 to less than 9 percent today, the lowest level in U.S. history. Health insurance is not yet universal, but it is in the process of universalizing, thanks to the president’s landmark bill.

Obama’s health care reform increased coverage primarily through several channels, expanding Medicaid for the poor, subsidizing private insurance plans for the middle class, and allowing young people to stay on their parents’ plans until they turn 27. Indeed, the largest reduction in the uninsured was among young people between 19 and 26. But perhaps this is the law’s greatest achievement: The uninsured rate among families living in poverty or just above the poverty line fell by almost 50 percent.

It is tricky to determine the “average” benefit of a health care plan, since unlike a tax credit, health care spending is, by definition, uncertain and spiky. Sick people need immediate and expensive care, while healthy individuals sometimes goes years without seeing a doctor or visiting a hospital. But there are some acceptable estimates. The Centers for Medicare & Medicaid Services has calculated that the average expenses covered by Medicaid under Obamacare next year will be about $5,400—or, about 15 percent of household income for a family of four at the threshold of Medicaid eligibility. The CBO estimated that the average benefit of individuals receiving subsidized coverage is $4,500.

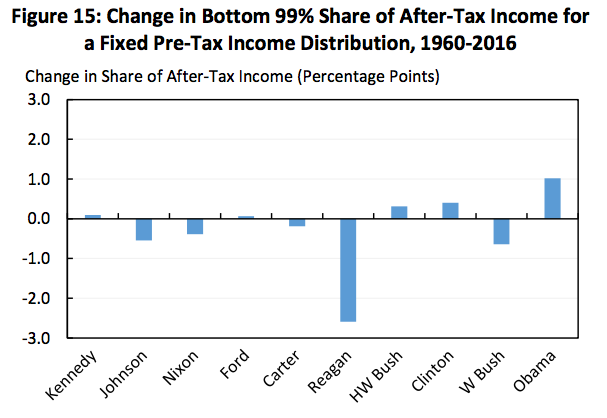

Second, several subtle yet significant tax changes under Obama have made the tax code more progressive. The stimulus bill passed in 2009, a.k.a., the American Recovery and Reinvestment Act of 2009 (or, simply, the Recovery Act), included the most important changes. The law created the Making Work Pay credit, expanded the Earned Income Tax Credit and Child Tax Credit, and created new tax credits, like the American Opportunity Tax Credit for college attendees. Most of these measures have been extended through 2017. The most significant change to the tax code since 2010 has been the eleventh-hour agreement to extend the Bush tax cuts for all families except for an increase in the top tax rate for households making more than $450,000 and an increase in the estate tax rate to 40 percent.

All told, these changes made the tax code more progressive over a period when the economic gains of the recovery went disproportionately toward the richest Americans. The richest 1 percent of households earned about 99 percent of the income gains in the years after the recession. But the most common measures of income inequality did not explode in this period. The reason why is fairly simple. Obama’s tax policies increased the non-1-percenters’ share of income more than any president since perhaps FDR.

Third, the Obama administration has supported initiatives outside of the tax code and health care policy to help the poor and middle class. They have been advocates for higher minimum wages at the national level, which have arguably buoyed the state-by-state effort to raise minimum wages toward $15 in richer areas. They supported extended unemployment benefits while long-term unemployment was perhaps the country’s most insidious economic plague. Unemployment insurance kept more than 11 million people out of poverty in Obama’s first term, according to Census analysis. The president also expanded Supplemental Nutrition Assistance Program (food stamps) and Temporary Aid to Needy Families (grants that states can use for a variety of measures including helping the poor). His Department of Education spent more than $60 billion to support states’ education budgets and prevent more layoffs of teachers and administrators. In sum, he grew anti-inequality spending more than any president, as a share of GDP.

It is easy to see an anti-inequality policy as a straightforward transfer from the lifelong rich to lifelong long. But life is long, and some people who start off middle-class become rich, while many people who are well off go through periods of need. For this reason, looking at a single year of taxes and transfers provides a limited and obstructed view of the expansive security of the social safety net that Obama’s policies have buttressed.

In 2006, just 20 percent of Americans under the age of 65 were uninsured for at least one month, but more than twice that many Americans had been uninsured for at least one month in the previous ten years. Even more powerfully: Sixty percent of Americans will fall into the bottom 20 percent of income for at least one year between their 20s and 60s. In a country where the majority of Americans are members of the “bottom 20 percent” at some point in their lives, it makes little sense to think of a permanent class of makers and a permanent class of takers. Americans are, rather, all interlocking parts of a vast social lattice of support, where security from misfortune is paid out of the pockets of the fortunate.

One of the loudest arguments against a strong social safety net is that so much technocratic tinkering may have a detrimental effect on the U.S. economy. For example, many Republicans warned that Obamacare would be a job killer that would sink the economy into the fresh hell of a double-dip recession.

But it hasn’t quite turned out that way. Private sector jobs have grown for 77 consecutive months, an American record. This month's Census data, one of the final report cards on Obama’s presidency, was historic in its optimism. It found that real median household incomes rose by 5.2 percent in 2015, also a record. Poorest Americans are seeing the fastest wage growth of all groups, not to mention the fastest wage growth they’ve ever experienced. After years of stagnation, average real wages are up nearly 6 percent since 2012, “more than all wage growth from 1973-2007,” according to the CEA.

Obama’s impressive achievements do not obviate the last few disappointing decades for American workers. But despite the Trump campaign’s creative take on time and causality, Obama shouldn’t be held accountable for economic trends that predate his presidency.

In fact, he probably shouldn’t even be held accountable for the economy when he is president. Overseeing the U.S. economy is not like building a ship, in which the president would theoretically serve as lead architect, with a blueprint and construction budget. It is more like sailing that ship through turbulent waters, where the president serves as master and commander but has little power to turn off the rain or request a calmer sea. Obama entered the White House with the vessel sinking and the rain coming in sideways; almost every economist agrees that his administration’s response helped to prevent a catastrophe.

“While presidents can’t control how fast the economy grows, they have more influence over how that growth is divided,” wrote Ben Casselman, an economics writer at FiveThirtyEight. That’s true, yet it undersells just how difficult it has become for a president in a divided Congress to create, enact, and defend an economic agenda.

A president’s legacy is always a matter of debate. Liberal historians may look back on the Obama administration and wonder why he didn’t push for a larger stimulus; break up the banks and roll back the financialization of the economy; empower unions; or take on corporate monopolists. Conservative historians will surely find parallel faults with his economic policy, from the weaknesses of Obamacare to his “war” on coal.

But at a time when both liberals and conservatives have become exquisitely aware of income inequality and its ills, the seemingly placid, cold, philosopher-in-chief did more to combat that inequity than any president in at least 50 years. For that, two words suffice: “Thanks, Obama.”

* This article originally stated that after-tax income inequality was the lowest this century. We regret the error.